Page 104 - Tata_Chemicals_yearly-reports-2020-2021

P. 104

Integrated Annual Report 2020-21

vii. Finance costs ` in crore (f) Details of significant changes in key Consolidated

FY FY % Financial ratios:

Particulars Change

2020-21 2019-20 Change

TCL 19 43 (24) (56) 1. Interest coverage ratio of the group has been reduced to

2.7 times (FY 2019-20: 4.7 times) due to lower-earning during

TCE Group 55 53 2 4

TCML 17 22 (5) (23) the current year compared to the previous year.

TCNA 201 131 70 53 2. Current ratio of the group has been improved to 1.5 times

Rallis 5 6 (1) (17) (FY 2019-20: 1.1 times) mainly due to refinancing of loan

Others and which has moved from current to non-current in FY 2020-21.

Eliminations 70 87 (17) (20)

Total 367 342 25 7 3. Net Profit Margin (%) of the Company has reduced to

4.3% (FY 2019-20: 9.9%) due to higher cost of goods sold,

Higher interest costs on account of increase in TCNA and TCE lower other income, higher depreciation and amortisation

Group mainly on account of one time refinance cost, partly offset expense.

by lower interest cost in TCL due to repayment of ECB and NCD in

the previous year. 4. Return on Net Worth (%) of the Company has reduced to

3.0% (FY 2019-20: 7.1%) due to higher cost of goods sold,

viii. Other expenses ` in crore lower other income, higher depreciation and amortisation

FY FY %

Particulars Change expense.

2020-21 2019-20 Change

TCL 461 447 14 3 (g) Total Debt and Amortisation Schedule

TCE Group 321 289 32 11

TCML 119 151 (32) (21) Repayment schedule of existing debt ` in crore

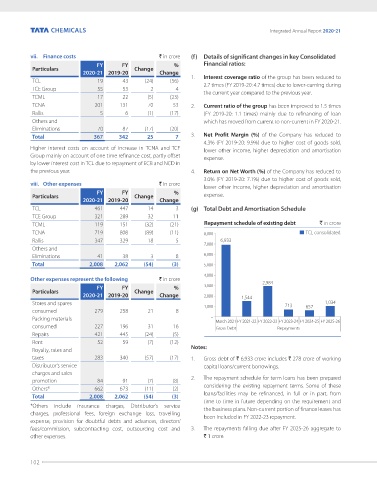

TCNA 719 808 (89) (11) 8,000 TCL consolidated

Rallis 347 329 18 5 6,933

Others and 7,000

Eliminations 41 38 3 8 6,000

Total 2,008 2,062 (54) (3) 5,000

4,000

Other expenses represent the following ` in crore 2,984

FY FY % 3,000

Particulars Change

2020-21 2019-20 Change 2,000 1,544

Stores and spares 1,000 713 657 1,034

consumed 279 258 21 8

Packing materials – March 2021 FY 2021-22 FY 2022-23 FY 2023-24 FY 2024-25 FY 2025-26

consumed 227 196 31 16 Gross Debt Repayments

Repairs 421 445 (24) (5)

Rent 52 59 (7) (12)

Royalty, rates and Notes:

taxes 283 340 (57) (17) 1. Gross debt of ` 6,933 crore includes ` 278 crore of working

Distributor's service capital loans/current borrowings.

charges and sales

promotion 84 91 (7) (8) 2. The repayment schedule for term loans has been prepared

Others* 662 673 (11) (2) considering the existing repayment terms. Some of these

Total 2,008 2,062 (54) (3) loans/facilities may be refinanced, in full or in part, from

time to time in future depending on the requirement and

*Others include insurance charges, Distributor’s service the business plans. Non-current portion of finance leases has

charges, professional fees, foreign exchange loss, travelling been included in FY 2022-23 repayment.

expense, provision for doubtful debts and advances, directors’

fees/commission, subcontracting cost, outsourcing cost and 3. The repayments falling due after FY 2025-26 aggregate to

other expenses. ` 1 crore.

102