Page 103 - Tata_Chemicals_yearly-reports-2020-2021

P. 103

Integrated Report Statutory Reports Financial Statements

1-59 Management Discussion and Analysis 147-300

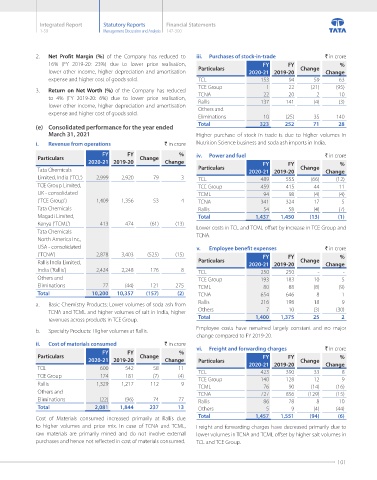

2. Net Profit Margin (%) of the Company has reduced to iii. Purchases of stock-in-trade ` in crore

16% (FY 2019-20: 23%) due to lower price realisation, FY FY %

lower other income, higher depreciation and amortisation Particulars 2020-21 2019-20 Change Change

expense and higher cost of goods sold. TCL 153 94 59 63

TCE Group 1 22 (21) (95)

3. Return on Net Worth (%) of the Company has reduced TCNA 22 20 2 10

to 4% (FY 2019-20: 6%) due to lower price realisation, Rallis 137 141 (4) (3)

lower other income, higher depreciation and amortisation Others and

expense and higher cost of goods sold.

Eliminations 10 (25) 35 140

(e) Consolidated performance for the year ended Total 323 252 71 28

March 31, 2021 Higher purchase of stock in trade is due to higher volumes in

i. Revenue from operations ` in crore Nutrition Science business and soda ash imports in India.

FY FY % iv. Power and fuel

Particulars Change ` in crore

2020-21 2019-20 Change FY FY %

Tata Chemicals Particulars 2020-21 2019-20 Change Change

Limited, India (‘TCL’) 2,999 2,920 79 3 TCL 489 555 (66) (12)

TCE Group Limited, TCE Group 459 415 44 11

UK - consolidated TCML 94 98 (4) (4)

('TCE Group') 1,409 1,356 53 4 TCNA 341 324 17 5

Tata Chemicals Rallis 54 58 (4) (7)

Magadi Limited, Total 1,437 1,450 (13) (1)

Kenya ('TCML') 413 474 (61) (13) Lower costs in TCL and TCML offset by increase in TCE Group and

Tata Chemicals TCNA.

North America Inc.,

USA - consolidated v. Employee benefit expenses ` in crore

(‘TCNA’) 2,878 3,403 (525) (15) FY FY %

Rallis India Limited, Particulars 2020-21 2019-20 Change Change

India (‘Rallis’) 2,424 2,248 176 8 TCL 250 250 - -

Others and TCE Group 193 183 10 5

Eliminations 77 (44) 121 275 TCML 80 88 (8) (9)

Total 10,200 10,357 (157) (2) TCNA 654 646 8 1

a. Basic Chemistry Products: Lower volumes of soda ash from Rallis 216 198 18 9

TCNA and TCML and higher volumes of salt in India, higher Others 7 10 (3) (30)

revenues across products in TCE Group. Total 1,400 1,375 25 2

Employee costs have remained largely constant and no major

b. Specialty Products: Higher volumes at Rallis.

change compared to FY 2019-20.

ii. Cost of materials consumed ` in crore

FY FY % vi. Freight and forwarding charges ` in crore

Particulars Change FY FY %

2020-21 2019-20 Change Particulars Change

TCL 600 542 58 11 TCL 2020-21 2019-20 33 Change 8

423

390

TCE Group 174 181 (7) (4) TCE Group 140 128 12 9

Rallis 1,329 1,217 112 9 TCML 76 90 (14) (16)

Others and TCNA 727 856 (129) (15)

Eliminations (22) (96) 74 77 Rallis 86 78 8 10

Total 2,081 1,844 237 13 Others 5 9 (4) (44)

Cost of Materials consumed increased primarily at Rallis due Total 1,457 1,551 (94) (6)

to higher volumes and price mix. In case of TCNA and TCML, Freight and forwarding charges have decreased primarily due to

raw materials are primarily mined and do not involve external lower volumes in TCNA and TCML offset by higher salt volumes in

purchases and hence not reflected in cost of materials consumed. TCL and TCE Group.

101