Page 102 - Tata_Chemicals_yearly-reports-2020-2021

P. 102

Integrated Annual Report 2020-21

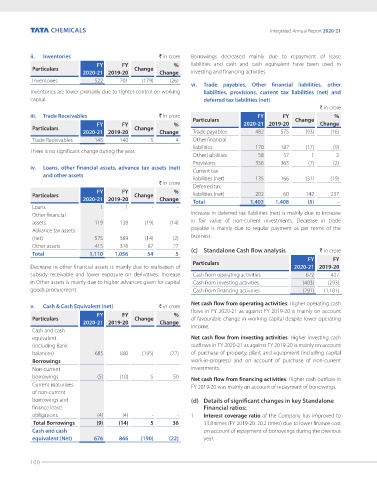

ii. Inventories ` in crore Borrowings decreased mainly due to repayment of lease

FY FY % liabilities and cash and cash equivalent have been used in

Particulars Change

2020-21 2019-20 Change investing and financing activities.

Inventories 522 701 (179) (26)

vi. Trade payables, Other financial liabilities, other

Inventories are lower primarily due to tighter control on working liabilities, provisions, current tax liabilities (net) and

capital. deferred tax liabilities (net)

` in crore

iii. Trade Receivables ` in crore Particulars FY FY Change %

FY FY % 2020-21 2019-20 Change

Particulars Change

2020-21 2019-20 Change Trade payables 482 575 (93) (16)

Trade Receivables 145 140 5 4 Other financial

liabilities 170 187 (17) (9)

There is no significant change during the year.

Other liabilities 58 57 1 2

Provisions 356 363 (7) (2)

iv. Loans, other financial assets, advance tax assets (net) Current tax

and other assets liabilities (net) 135 166 (31) (19)

` in crore Deferred tax

FY FY %

Particulars Change liabilities (net) 202 60 142 237

2020-21 2019-20 Change Total 1,403 1,408 (5) -

Loans 1 1 - -

Other financial Increase in deferred tax liabilities (net) is mainly due to increase

assets 119 138 (19) (14) in fair value of non-current investments. Decrease in trade

Advance tax assets payable is mainly due to regular payment as per terms of the

(net) 575 589 (14) (2) business.

Other assets 415 328 87 27

Total 1,110 1,056 54 5 (c) Standalone Cash flow analysis ` in crore

Particulars FY FY

Decrease in other financial assets is mainly due to realisation of 2020-21 2019-20

subsidy receivable and lower exposure on derivatives. Increase Cash from operating activities 672 427

in Other assets is mainly due to higher advances given for capital Cash from investing activities (403) (293)

goods procurement. Cash from financing activities (291) (1,101)

Net cash flow from operating activities: Higher operating cash

v. Cash & Cash Equivalent (net) ` in crore

FY FY % flows in FY 2020-21 as against FY 2019-20 is mainly on account

Particulars Change of favourable change in working capital despite lower operating

2020-21 2019-20 Change income.

Cash and cash

equivalent Net cash flow from investing activities: Higher investing cash

(including Bank outflows in FY 2020-21 as against FY 2019-20 is mainly on account

balances) 685 880 (195) (22) of purchase of property, plant and equipment (including capital

Borrowings work-in-progress) and on account of purchase of non-current

Non-current investments.

borrowings (5) (10) 5 50 Net cash flow from financing activities: Higher cash outflow in

Current maturities FY 2019-20 was mainly on account of repayment of borrowings.

of non-current

borrowings and (d) Details of significant changes in key Standalone

finance lease Financial ratios:

obligations (4) (4) - - 1. Interest coverage ratio of the Company has improved to

Total Borrowings (9) (14) 5 36 33.8 times (FY 2019-20: 20.2 times) due to lower finance cost

Cash and cash on account of repayment of borrowings during the previous

equivalent (Net) 676 866 (190) (22) year.

100