Page 59 - Tata_Chemicals_yearly-reports-2019-20

P. 59

Integrated report Statutory reportS Financial StatementS

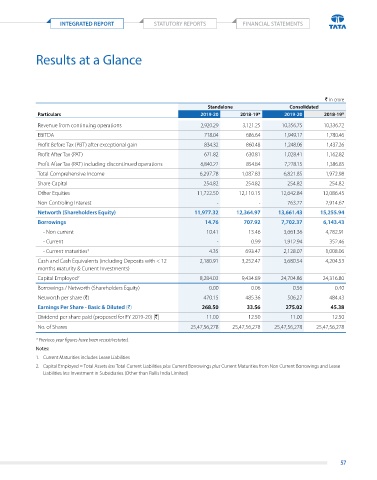

Results at a Glance

` in crore

Standalone Consolidated

Particulars 2019-20 2018-19* 2019-20 2018-19*

Revenue from continuing operations 2,920.29 3,121.25 10,356.75 10,336.72

EBITDA 718.04 686.64 1,949.17 1,780.46

Profit Before Tax (PBT) after exceptional gain 834.32 860.48 1,248.06 1,437.26

Profit After Tax (PAT) 671.82 630.81 1,028.41 1,162.82

Profit After Tax (PAT) including discontinued operations 6,840.22 854.84 7,228.15 1,386.85

Total Comprehensive Income 6,297.78 1,087.83 6,821.85 1,972.98

Share Capital 254.82 254.82 254.82 254.82

Other Equities 11,722.50 12,110.15 12,642.84 12,086.45

Non Controling Interest - - 763.77 2,914.67

Networth (Shareholders Equity) 11,977.32 12,364.97 13,661.43 15,255.94

Borrowings 14.76 707.92 7,702.37 6,143.43

- Non current 10.41 13.46 3,661.36 4,782.91

- Current - 0.99 1,912.94 352.46

- Current maturities 1 4.35 693.47 2,128.07 1,008.06

Cash and Cash Equivalents (including Deposits with < 12 2,180.91 3,252.47 3,680.54 4,204.53

months maturity & Current Investments)

Capital Employed 2 8,284.03 9,434.89 24,704.86 24,316.80

Borrowings / Networth (Shareholders Equity) 0.00 0.06 0.56 0.40

Networth per share (`) 470.15 485.36 506.27 484.43

Earnings Per Share - Basic & Diluted (`) 268.50 33.56 275.02 45.38

Dividend per share paid (proposed for FY 2019-20) [`] 11.00 12.50 11.00 12.50

No. of Shares 25,47,56,278 25,47,56,278 25,47,56,278 25,47,56,278

* Previous year figures have been recast/restated.

Notes:

1. Current Maturities includes Lease Liabilities

2. Capital Employed = Total Assets less Total Current Liabilities plus Current Borrowings plus Current Maturities from Non Current Borrowings and Lease

Liabilities less Investment in Subsidiaries (Other than Rallis India Limited)

57