Page 60 - Tata_Chemicals_yearly-reports-2019-20

P. 60

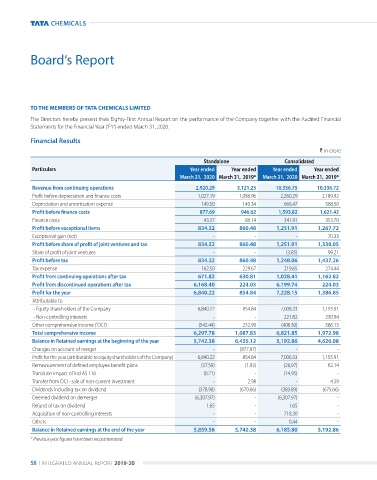

Board‘s Report

TO THE MEMBERS OF TATA CHEMICALS LIMITED

the directors hereby present their eighty-First annual report on the performance of the Company together with the audited Financial

Statements for the Financial Year (‘FY’) ended March 31, 2020.

Financial Results

` in crore

Standalone Consolidated

Particulars Year ended Year ended Year ended Year ended

March 31, 2020 March 31, 2019* March 31, 2020 March 31, 2019*

Revenue from continuing operations 2,920.29 3,121.25 10,356.75 10,336.72

profit before depreciation and finance costs 1,027.19 1,086.96 2,260.29 2,189.92

depreciation and amortisation expense 149.50 140.34 666.47 568.50

Profit before finance costs 877.69 946.62 1,593.82 1,621.42

Finance costs 43.37 86.14 341.91 353.70

Profit before exceptional items 834.32 860.48 1,251.91 1,267.72

exceptional gain (net) - - - 70.33

Profit before share of profit of joint ventures and tax 834.32 860.48 1,251.91 1,338.05

Share of profit of joint ventures - - (3.85) 99.21

Profit before tax 834.32 860.48 1,248.06 1,437.26

tax expense 162.50 229.67 219.65 274.44

Profit from continuing operations after tax 671.82 630.81 1,028.41 1,162.82

Profit from discontinued operations after tax 6,168.40 224.03 6,199.74 224.03

Profit for the year 6,840.22 854.84 7,228.15 1,386.85

attributable to:

- equity shareholders of the Company 6,840.22 854.84 7,006.33 1,155.91

- non-controlling interests - - 221.82 230.94

other comprehensive income (‘oCI’) (542.44) 232.99 (406.30) 586.13

Total comprehensive income 6,297.78 1,087.83 6,821.85 1,972.98

Balance in Retained earnings at the beginning of the year 5,742.38 6,435.12 5,192.86 4,626.08

Changes on account of merger - (877.97) - -

profit for the year (attributable to equity shareholders of the Company) 6,840.22 854.84 7,006.33 1,155.91

remeasurement of defined employee benefit plans (37.59) (1.93) (26.97) 82.14

transition impact of Ind aS 116 (0.21) - (14.95) -

transfer from oCI - sale of non-current investment - 2.98 - 4.39

dividends including tax on dividend (378.90) (670.66) (383.89) (675.66)

deemed dividend on demerger (6,307.97) - (6,307.97) -

refund of tax on dividend 1.65 - 1.65 -

acquisition of non-controlling interests - - 718.30 -

others - - 0.44 -

Balance in Retained earnings at the end of the year 5,859.58 5,742.38 6,185.80 5,192.86

* Previous year figures have been recast/restated.

58 I Integrated annual report 2019-20