Page 252 - Tata_Chemicals_yearly-reports-2017-18

P. 252

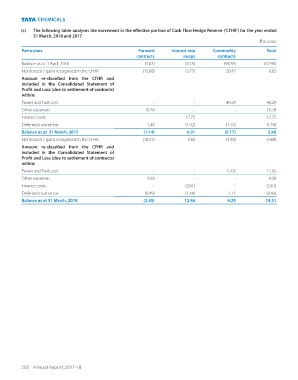

(c) The following table analyses the movement in the effective portion of Cash Flow Hedge Reserve (‘CFHR’) for the year ended

31 March, 2018 and 2017

` in crore

Particulars Forward Interest rate Commodity Total

contracts swaps contracts

Balance as at 1 April, 2016 (3.02) (5.15) (59.78) (67.95)

Net (losses) / gains recognised in the CFHR (15.88) (3.77) 20.47 0.82

Amount re-classified from the CFHR and

included in the Consolidated Statement of

Profit and Loss (due to settlement of contracts)

within:

Power and Fuel cost - - 40.29 40.29

Other expenses 16.28 - - 16.28

Finance costs - 17.75 - 17.75

Deferred income tax 1.48 (1.92) (1.15) (1.59)

Balance as at 31 March, 2017 (1.14) 6.91 (0.17) 5.60

Net (losses) / gains recognised in the CFHR (10.21) 9.82 (4.30) (4.69)

Amount re-classified from the CFHR and

included in the Consolidated Statement of

Profit and Loss (due to settlement of contracts)

within:

Power and Fuel cost - - 12.05 12.05

Other expenses 9.38 - - 9.38

Finance costs - (2.61) - (2.61)

Deferred income tax (0.49) (1.66) 1.71 (0.43)

Balance as at 31 March, 2018 (2.45) 12.46 9.29 19.31

250 Annual Report 2017-18