Page 221 - Tata_Chemicals_yearly-reports-2017-18

P. 221

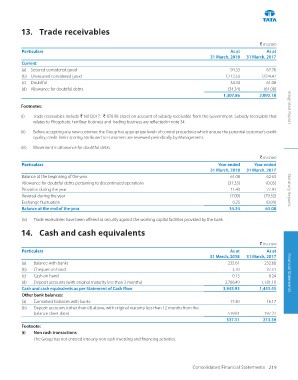

13. Trade receivables

` in crore

Particulars As at As at

31 March, 2018 31 March, 2017

Current

(a) Secured considered good 94.33 67.76

(b) Unsecured considered good 1,213.53 2,024.42

(c) Doubtful 34.34 61.08

(d) Allowance for doubtful debts (34.34) (61.08)

1,307.86 2,092.18

Footnotes: Integrated Report

(i) Trade receivables include ` Nil (2017: ` 870.98 crore) on account of subsidy receivable from the Government. Subsidy receivable that

relates to Phosphatic Fertiliser business and Trading business are reflected in note 34.

(ii) Before accepting any new customer, the Group has appropriate levels of control procedures which ensure the potential customer’s credit

quality; credit limits scoring attributed to customers are reviewed periodically by Management.

(iii) Movement in allowance for doubtful debts

` in crore

Particulars Year ended Year ended

31 March, 2018 31 March, 2017

Balance at the beginning of the year 61.08 62.63

Allowance for doubtful debts pertaining to discontinued operations (31.33) (0.05)

Provision during the year 11.43 77.91 Statutory Reports

Reversal during the year (7.09) (79.32)

Exchange fluctuation 0.25 (0.09)

Balance at the end of the year 34.34 61.08

(iv) Trade receivables have been offered as security against the working capital facilities provided by the bank.

14. Cash and cash equivalents

` in crore

Particulars As at As at

31 March, 2018 31 March, 2017

(a) Balance with banks 235.61 232.60

(b) Cheques on hand 3.70 37.51

(c) Cash on hand 0.13 0.24 Financial Statements

(d) Deposit accounts (with original maturity less than 3 months) 3,706.49 1,181.10

Cash and cash equivalents as per Statement of Cash Flow 3,945.93 1,451.45

Other bank balances:

(a) Earmarked balances with banks 17.30 16.17

(b) Deposit accounts (other than (d) above, with original maturity less than 12 months from the

balance sheet date) 519.81 197.22

537.11 213.39

Footnote:

(i) Non cash transactions

The Group has not entered into any non cash investing and financing activities.

Consolidated Financial Statements 219