Page 217 - Tata_Chemicals_yearly-reports-2017-18

P. 217

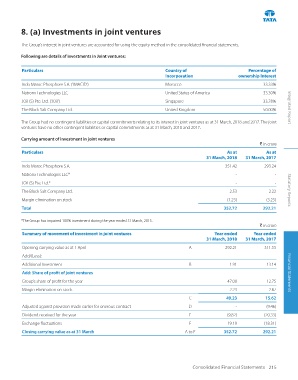

8. (a) Investments in joint ventures

The Group’s interest in joint ventures are accounted for using the equity method in the consolidated financial statements.

Following are details of investments in Joint ventures:

Particulars Country of Percentage of

Incorporation ownership Interest

Indo Maroc Phosphore S.A. (‘IMACID’) Morocco 33.33%

Natronx Technologies LLC United States of America 33.30%

JOil (S) Pte. Ltd. (‘JOil’) Singapore 33.78%

The Block Salt Company Ltd. United Kingdom 50.00% Integrated Report

The Group had no contingent liabilities or capital commitments relating to its interest in joint ventures as at 31 March, 2018 and 2017. The joint

ventures have no other contingent liabilities or capital commitments as at 31 March, 2018 and 2017.

Carrying amount of investment in joint ventures

` in crore

Particulars As at As at

31 March, 2018 31 March, 2017

Indo Maroc Phosphore S.A. 351.42 293.24

Natronx Technologies LLC* - -

JOil (S) Pte. Ltd.* - -

The Block Salt Company Ltd. 2.53 2.22 Statutory Reports

Margin elimination on stock (1.23) (3.25)

Total 352.72 292.21

*The Group has impaired 100% investment during the year ended 31 March, 2015.

` in crore

Summary of movement of investment in joint ventures Year ended Year ended

31 March, 2018 31 March, 2017

Opening carrying value as at 1 April A 292.21 311.55

Add/(Less):

Additional Investment B 1.91 13.14

Add: Share of profit of joint ventures Financial Statements

Group’s share of profit for the year 47.00 12.75

Margin elimination on stock 2.23 2.87

C 49.23 15.62

Adjusted against provision made earlier for onerous contract D - (9.46)

Dividend received for the year E (9.82) (20.33)

Exchange fluctuations F 19.19 (18.31)

Closing carrying value as at 31 March A to F 352.72 292.21

Consolidated Financial Statements 215