Page 225 - Tata_Chemicals_yearly-reports-2017-18

P. 225

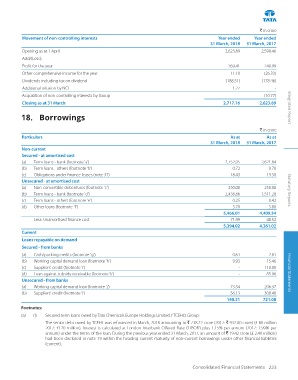

` in crore

Movement of non-controlling interests Year ended Year ended

31 March, 2018 31 March, 2017

Opening as at 1 April 2,623.89 2,598.46

Add/(Less):

Profit for the year 269.41 240.99

Other comprehensive income for the year 11.10 (26.33)

Dividends including tax on dividend (188.51) (178.46)

Additional infusion by NCI 1.27 -

Acquisition of non-controlling interests by Group - (10.77)

Closing as at 31 March 2,717.16 2,623.89 Integrated Report

18. Borrowings

` in crore

Particulars As at As at

31 March, 2018 31 March, 2017

Non-current

Secured - at amortised cost

(a) Term loans - bank (footnote 'a') 2,752.05 2,621.84

(b) Term loans - others (footnote 'b') 0.72 0.70

(c) Obligations under finance leases (note 37) 18.43 19.50

Unsecured - at amortised cost

(a) Non-convertible debentures (footnote 'c') 250.00 250.00 Statutory Reports

(b) Term loans - bank (footnote 'd') 2,438.86 1,511.28

(c) Term loans - others (footnote 'e') 0.25 0.42

(d) Other loans (footnote 'f') 5.70 5.80

5,466.01 4,409.54

Less: Unamortised finance cost 71.99 48.52

5,394.02 4,361.02

Current

Loans repayable on demand

Secured - from banks

(a) Cash/packing credits (footnote 'g') 0.61 2.81

(b) Working capital demand loan (footnote 'h') 9.93 15.46

(c) Suppliers' credit (footnote 'i') - 110.00

(d) Loan against subsidy receivable (footnote 'k') - 85.96 Financial Statements

Unsecured - from banks

(a) Working capital demand loan (footnote 'j') 73.54 206.37

(b) Suppliers' credit (footnote 'i’) 56.13 300.48

140.21 721.08

Footnotes:

(a) (i) Secured term loans owed by Tata Chemicals Europe Holdings Limited (‘TCEHL’) Group:

The senior debt owed by TCEHL was refinanced in March, 2018 amounting to ` 738.22 crore (2017: ` 932.00 crore) (£ 80 million

2017: £120 million). Interest is calculated at London Interbank Offered Rate (‘LIBOR’) plus 1.15% per annum (2017: 1.99% per

annum) under the terms of the loan. During the previous year ended 31 March, 2017, an amount of ` 19.42 crore (£ 2.40 million)

had been disclosed in note 19 within the heading current maturity of non-current borrowings under other financial liabilities

(current).

Consolidated Financial Statements 223