Page 53 - Tata Chemical Annual Report_2022-2023

P. 53

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Managing Risk and Ensuring

Business Resilience

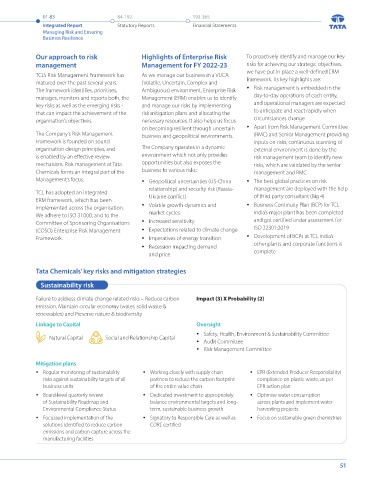

Managing Risk and Ensuring Business Our approach to risk Highlights of Enterprise Risk To proactively identify and manage our key

risks for achieving our strategic objectives,

Management for FY 2022-23

management

Resilience TCL’s Risk Management Framework has As we manage our business in a VUCA we have put in place a well-defined ERM

framework. Its key highlights are:

matured over the past several years. (Volatile, Uncertain, Complex and

We believe that effective risk identification Risk mapping The framework identifies, prioritises, Ambiguous) environment, Enterprise Risk Risk management is embedded in the

day-to-day operations of each entity,

and management is vital for business manages, monitors and reports both, the Management (ERM) enables us to identify and operational managers are expected

to be resilient and grow sustainably. We High key risks as well as the emerging risks - and manage our risks by implementing

periodically assess the risks that the Company 1 that can impact the achievement of the risk mitigation plans and allocating the to anticipate and react rapidly when

faces in its business operations and invest 5 organisation’s objectives. necessary resources. It also helps us focus circumstances change

in minimising the same through concerted on becoming resilient through uncertain Apart from Risk Management Committee

initiatives. The Company’s Risk Management business and geopolitical environments. (RMC) and Senior Management providing

Framework is founded on sound inputs on risks, continuous scanning of

The risk-related information outlined in organisation design principles, and The Company operates in a dynamic

this section is not exhaustive and is for environment which not only provides external environment is done by the

information purposes only. The section lists 3 10 7 is enabled by an effective review opportunities but also exposes the risk management team to identify new

forward–looking statements that may involve 8 mechanism. Risk management at Tata business to various risks: risks, which are validated by the senior

risks and uncertainties. Our actual results, 9 Chemicals forms an integral part of the management and RMC

including business operational performance, Impact Medium 6 Management’s focus. Geopolitical uncertainties (US-China The best global practices on risk

could differ materially on account of risks 4 2 relationship) and security risk (Russia- management are deployed with the help

and uncertainties not currently envisaged, or TCL has adopted an integrated Ukraine conflict) of third party consultant (Big 4)

due to risks that we currently believe are not ERM framework, which has been Volatile growth dynamics and Business Continuity Plan (BCP) for TCL

material. Readers are also advised to exercise implemented across the organisation.

their own judgement in assessing the risks We adhere to ISO 31000, and to the market cycles India’s major plant has been completed

associated with the Company. Committee of Sponsoring Organisations Increased sensitivity and got certified under assessment for

(COSO) Enterprise Risk Management Expectations related to climate change ISO 22301:2019

Risk Category Framework. Imperatives of energy transition Development of BCPs at TCL India’s

1 Sustainability 2 Strategic 3 Operational Recession impacting demand other plants and corporate functions is

Low and price complete

4 Financial 5 Regulatory and Policy Low Medium High

6 Reputational Probability Tata Chemicals’ key risks and mitigation strategies

Sr. Key Risks & Category Risk Description Change in Rating over 2021-22 Sustainability risk

No. Probability Impact

Failure to address climate change related risks – Reduce carbon Impact (3) X Probability (2)

1 Sustainability risk 1 Failure to address climate change related risks – Reducing carbon No Change No Change

emission, maintaining circular economy (water, solid waste & emission, Maintain circular economy (water, solid waste &

renewables) and Preserving nature & biodiversity renewables) and Preserve nature & biodiversity

2 Recession risk Recession fuelled by rising interest rates, impacting demand and price New Risk Linkage to Capital Oversight

3 Digitalisation risk Embracing digitalisation as a key lever of business growth No Change No Change Natural Capital Social and Relationship Capital Safety, Health, Environment & Sustainability Committee

2 Audit Committee

4 Talent risk Challenges of attracting and retaining talent in remote New Risk Risk Management Committee

manufacturing locations

5 Cyber risk Loss of data & compromised operations resulting from cyber attacks No Change No Change Mitigation plans

6 High energy costs 3 High energy costs (high prices of energy sources like oil, natural Reduced Reduced Regular monitoring of sustainability Working closely with supply chain EPR (Extended Producer Responsibility)

risk & supply chain gas, coal will impact variable costs) & supply chain constraints risks against sustainability targets of all partners to reduce the carbon footprint compliance on plastic waste, as per

constraints risk (higher freight costs and longer delivery cycles) business units of the entire value chain EPR action plan

7 International debt risk Managing international debt and tightening interest rates No Change No Change Board-level quarterly review Dedicated investment to appropriately Optimise water consumption

4 of Sustainability Roadmap and balance environmental targets and long- across plants and implement water

8 Unfunded pension risk Unfunded pension liabilities of overseas subsidiaries No Change No Change Environmental Compliance Status term, sustainable business growth harvesting projects

(UK Natrium Holdings)

Focussed implementation of the Signatory to Responsible Care as well as Focus on sustainable green chemistries

9 Regulatory & policy risk 5 Policy changes which could impact the Company’s operations at large No Change No Change solutions identified to reduce carbon CORE certified

10 Safety risk 6 Ensuring containment of safety hazards (behaviour, workplace, No Change No Change emissions and carbon capture across the

process and product) manufacturing facilities

50 51