Page 364 - Tata Chemical Annual Report_2022-2023

P. 364

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

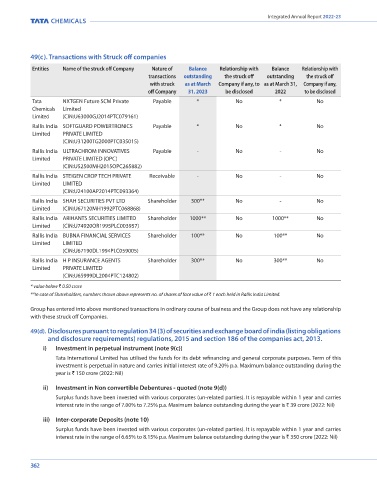

49(c). Transactions with Struck off companies iv) Particulars of investments in Joint ventures and associates and other investments are given in note 9.

Entities Name of the struck off Company Nature of Balance Relationship with Balance Relationship with v) The Group has not provided any guarantee or security covered under Section 186 and accordingly, the disclosure

transactions outstanding the struck off outstanding the struck off requirements to that extent does not apply to the Company/Group.

with struck as at March Company if any, to as at March 31, Company if any, vi) In line with Circular No 04/2015 issued by Ministry of Corporate Affairs dated 10/03/2015, loans given to employees as per

off Company 31, 2023 be disclosed 2022 to be disclosed

the Group’s policy are not considered for the purposes of disclosure under Section 186(4) of the Companies Act, 2013.

Tata NXTGEN Future SCM Private Payable * No * No

Chemicals Limited 50. Approval of Consolidated Financial Statements

Limited (CIN:U63000GJ2014PTC079161) These Consolidated Financial Statements were approved for issue by the Board of Directors on May 3, 2023.

Rallis India SOFTGUARD POWERTRONICS Payable * No * No

Limited PRIVATE LIMITED Signatures to notes 1 to 50 are an integral part of these Consolidated Financial Statements

(CIN:U31200TG2000PTC035015)

Rallis India ULTRACHROM INNOVATIVES Payable - No - No As per our report of even date attached For and on behalf of the Board

Limited PRIVATE LIMITED (OPC) For B S R & Co. LLP N. Chandrasekaran Chairman

(CIN:U52500MH2015OPC265882) Chartered Accountants (DIN: 00121863)

Rallis India STEIGEN CROP TECH PRIVATE Receivable - No - No Firm's Registration No: 101248W/W - 100022 Padmini Khare Kaicker Director

Limited LIMITED (DIN: 00296388)

(CIN:U24100AP2014PTC093364) R. Mukundan Managing Director and CEO

(DIN: 00778253)

Rallis India SHAH SECURITIES PVT LTD Shareholder 300** No - No Vijay Mathur Nandakumar S. Tirumalai Chief Financial Officer

Limited (CIN:U67120MH1992PTC068868) Partner (ICAI M. No.: 203896)

Rallis India ARIHANTS SECURITIES LIMITED Shareholder 1000** No 1000** No Membership No. 046476 Rajiv Chandan Chief General Counsel & Company Secretary

Limited (CIN:U74920OR1995PLC003957) Mumbai, May 3, 2023 (ICSI M. No.: FCS 4312)

Rallis India BUBNA FINANCIAL SERVICES Shareholder 100** No 100** No

Limited LIMITED

(CIN:U67190DL1994PLC059005)

Rallis India H P INSURANCE AGENTS Shareholder 300** No 300** No

Limited PRIVATE LIMITED

(CIN:U65999DL2004PTC124802)

* value below ` 0.50 crore

**In case of Shareholders, numbers shown above represents no. of shares of face value of ` 1 each held in Rallis India Limited.

Group has entered into above mentioned transactions in ordinary course of business and the Group does not have any relationship

with these struck off Companies.

49(d). Disclosures pursuant to regulation 34 (3) of securities and exchange board of india (listing obligations

and disclosure requirements) regulations, 2015 and section 186 of the companies act, 2013.

i) Investment in perpetual instrument (note 9(c))

Tata International Limited has utilised the funds for its debt refinancing and general corporate purposes. Term of this

investment is perpetual in nature and carries initial interest rate of 9.20% p.a. Maximum balance outstanding during the

year is ` 150 crore (2022: Nil)

ii) Investment in Non convertible Debentures - quoted (note 9(d))

Surplus funds have been invested with various corporates (un-related parties). It is repayable within 1 year and carries

interest rate in the range of 7.00% to 7.25% p.a. Maximum balance outstanding during the year is ` 39 crore (2022: Nil)

iii) Inter-corporate Deposits (note 10)

Surplus funds have been invested with various corporates (un-related parties). It is repayable within 1 year and carries

interest rate in the range of 6.65% to 8.15% p.a. Maximum balance outstanding during the year is ` 350 crore (2022: Nil)

362 363