Page 361 - Tata Chemical Annual Report_2022-2023

P. 361

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Consolidated

2. The above figures do not include provision for Compensated absences and contribution to gratuity fund, as separate figures are (d) Rallis has taken four godowns on lease from Mumbai Port Authority (MbPA), erstwhile Bombay Port Trust and has received

not available for the Managing Director and Whole-time Director. demand notices from MbPA of ` 50 crore towards differential arrears of rentals for the period October, 2012 upto March,

2023 for these godowns. Based on the legal advice received by Rallis, the demand raised by MbPA is being contested

3. The sales to and purchases from related parties including other transactions with them are made in the normal course of business and a suitable reply has been filed.

and on terms equivalent to those that prevail in arm’s length transactions.

46. Commitments (e) Various claims pending before Industrial Tribunals and Labour Courts of which amounts are indeterminate.

` in crore ** The Company has on-going disputes with income tax authorities mainly pertaining to disallowance of expenses and the

As at As at computation of, or eligibility of the Company’s availment of certain tax incentives or allowances. Most of these disputes

Particulars and/or disallowances are repetitive in nature spanning across multiple years. All the Tax demands are being contested by

March 31, 2023 March 31, 2022

the company.

Estimated amount of contracts remaining to be executed on capital account 817 831

and not provided for

@ Excise Duty cases include disputes pertaining to reversal of input tax credit on common input, refund of duty paid under

protest. Custom Duty cases include disputes pertaining to import of capital equipment against scripts, tariff classification

47. Contingent liabilities and assets issues, denial of FTA benefit. VAT/CST/Entry Tax cases include disputes pertaining to Way Bill, reversal/disallowance of input

47.1 Contingent liabilities tax credit, pending declaration forms. All the Tax demands are being contested by the company.

(a) Claims not acknowledged by the Group relating to cases contested by the Group and which, in the opinion of the

Management, are not likely to devolve on the Group relating to the following areas: It is not practicable for the Group to estimate the timings of cash outflows, if any, in respect of the above pending resolution

of the respective proceedings as it is determinable only on receipt of judgments/decisions pending with various forums/

` in crore authorities.

As at As at

Particulars

March 31, 2023 March 31, 2022 The Group has reviewed all its pending litigations and proceedings and has adequately provided for where provisions are

(i) Excise, Customs and Service Tax @ 83 83 required and disclosed as contingent liabilities where applicable, in the Consolidated Financial Statements.

(ii) Sales Tax / GST @ 50 52

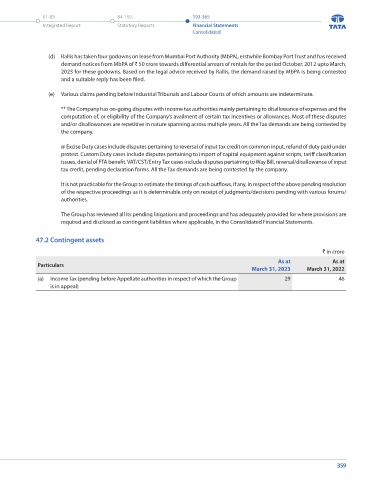

47.2 Contingent assets

(iii) Labour and other claims against the Group not acknowledged as debt 12 11

(iv) Income Tax (pending before Appellate authorities in respect of which 902 895 ` in crore

the Group is in appeal) ** As at As at

Particulars

(v) Income Tax (decided in Group's favour by Appellate authorities and 16 16 March 31, 2023 March 31, 2022

Department is in further appeal) (a) Income Tax (pending before Appellate authorities in respect of which the Group 29 46

(vi) Contractual obligation - Others (note d) 52 5 is in appeal)

(b) Land rates Demand for ` 711 crore (KShs 11.48 Billion) (2022: ` 678 crore (KShs 10.28 Billion)

On May 3, 2019, the High Court delivered its judgement in respect of the petition against a demand for land rates

levied on the Subsidiary Company by the Kajiado County Government during the year. The Court’s judgment quashed

this demand in entirety. In its judgement, the court also ordered that both parties submit themselves to a consultation

process to be led by the Cabinet Secretary for Mining, supervised by the Court in order to agree on the acreage to which

land rates should be levied. Following the lapse of period for negotiations as directed by the High Court, the company

proceeded to the court of appeal to seek directions on the land rates and the Court of Appeal is yet to give a hearing

date. On February 20, 2023, the Kajiado County issued an adjusted demand of ` 711 crore (KShs 11.48 Billion) (2022:

` 678 crore (KShs 10.28 Billion) for outstanding land rates, which was objected to. The Subsidiary company has also

approached the Ministry of Mining to intervene and try to have the matter resolved. In the opinion of management,

after taking appropriate legal advice, the liability is not considered to be probable at this stage and hence it has been

disclosed as a contingent liability.

(c) In respect of UK operations, there are certain ongoing claims from customers/vendors for potential non compliance with

contractual matters. In the opinion of management, after taking appropriate legal advice, the amounts are presently not

determinable and liability, if any, is not considered to be probable at this stage and hence these have been disclosed as a

contingent liability.

358 359