Page 229 - Tata Chemical Annual Report_2022-2023

P. 229

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Standalone

5. Investment property 6 Right of use assets

` in crore ` in crore

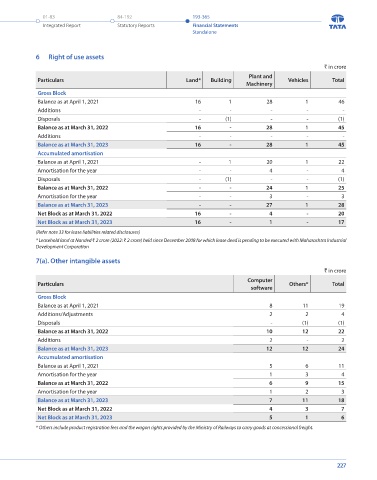

Particulars Land Building Total Plant and

Particulars Land* Building Vehicles Total

Gross Block Machinery

Balance as at April 1, 2021 17 47 64 Gross Block

Balance as at April 1, 2021 16 1 28 1 46

Additions - - -

Additions - - - - -

Balance as at March 31, 2022 17 47 64

Disposals - (1) - - (1)

Additions - - -

Balance as at March 31, 2022 16 - 28 1 45

Balance as at March 31, 2023 17 47 64 Additions - - - - -

Accumulated Depreciation Balance as at March 31, 2023 16 - 28 1 45

Balance as at April 1, 2021 - 10 10 Accumulated amortisation

Depreciation for the year - 1 1 Balance as at April 1, 2021 - 1 20 1 22

Balance as at March 31, 2022 - 11 11 Amortisation for the year - - 4 - 4

Disposals - (1) - - (1)

Depreciation for the year - 1 1

Balance as at March 31, 2022 - - 24 1 25

Balance as at March 31, 2023 - 12 12

Amortisation for the year - - 3 - 3

Net Block as at March 31, 2022 17 36 53

Balance as at March 31, 2023 - - 27 1 28

Net Block as at March 31, 2023 17 35 52 Net Block as at March 31, 2022 16 - 4 - 20

Net Block as at March 31, 2023 16 - 1 - 17

Footnotes:

(Refer note 33 for lease liabilities related disclosures)

a) Disclosures relating to fair valuation of investment property

* Leasehold land at Nanded ` 2 crore (2022: ` 2 crore) held since December 2008 for which lease deed is pending to be executed with Maharashtra Industrial

Fair value of the above investment property as at March 31, 2023 is ` 260 crore (2022: ` 260 crore) based on external valuation. Development Corporation

Fair Value Hierarchy 7(a). Other intangible assets

The fair value of investment property has been determined by external independent registered valuers as defined under rule ` in crore

2 of Companies (Registered Valuers and Valuation) Rules, 2017, having appropriate recognised professional qualification and Computer

recent experience in the location and category of the property being valued. Particulars software Others* Total

Gross Block

The fair value measurement for all of the investment property has been categorised as a level 3 fair value based on the inputs

to the valuation techniques used. Balance as at April 1, 2021 8 11 19

Additions/Adjustments 2 2 4

Description of valuation technique used Disposals - (1) (1)

The Company obtains independent valuations of its investment property after every three years. The fair value of the investment Balance as at March 31, 2022 10 12 22

property have been derived using the Direct Comparison Method. The direct comparison approach involves a comparison of the Additions 2 - 2

investment property to similar properties that have actually been sold in arms-length distance from investment property or are Balance as at March 31, 2023 12 12 24

offered for sale in the same region. This approach demonstrates what buyers have historically been willing to pay (and sellers Accumulated amortisation

willing to accept) for similar properties in an open and competitive market, and is particularly useful in estimating the value of Balance as at April 1, 2021 5 6 11

the land and properties that are typically traded on a unit basis. This approach leads to a reasonable estimation of the prevailing

price. Given that the comparable instances are located in close proximity to the investment property; these instances have been Amortisation for the year 1 3 4

assessed for their locational comparative advantages and disadvantages while arriving at the indicative price assessment for Balance as at March 31, 2022 6 9 15

investment property. Amortisation for the year 1 2 3

Balance as at March 31, 2023 7 11 18

b) The Company has not earned any material rental income on the above properties. Net Block as at March 31, 2022 4 3 7

Net Block as at March 31, 2023 5 1 6

* Others include product registration fees and the wagon rights provided by the Ministry of Railways to carry goods at concessional freight.

226 227