Page 33 - Tata_Chemicals_yearly-reports-2021-22

P. 33

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

Integrated Annual Report 2021-22 REPORT REPORTS STATEMENTS

Risk Management

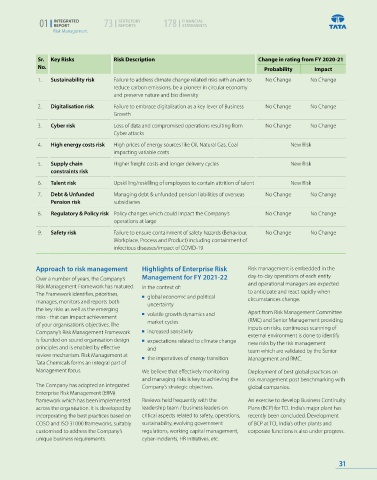

Risk Management Sr. Key Risks Risk Description Change in rating from FY 2020-21

No. Probability Impact

1. Sustainability risk Failure to address climate change related risks with an aim to No Change No Change

reduce carbon emissions, be a pioneer in circular economy

The risk-related information Risk mapping and preserve nature and bio diversity

outlined in this section is not High 2. Digitalisation risk Failure to embrace digitalisation as a key lever of Business No Change No Change

exhaustive and is for information Growth

purposes only. This section lists 1 3 4 3. Cyber risk Loss of data and compromised operations resulting from No Change No Change

forward-looking statements 7 Cyber attacks

that may involve risks and 4. High energy costs risk High prices of energy sources like Oil, Natural Gas, Coal New Risk

uncertainties. Our actual results impacting variable costs

including business operational 2 5. Supply chain Higher freight costs and longer delivery cycles New Risk

constraints risk

performance could differ 8 6

materially on account of risks Impact Medium 5 9 6. Talent risk Upskilling/reskilling of employees to contain attrition of talent New Risk

and uncertainties not currently 7. Debt & Unfunded Managing debt & unfunded pension liabilities of overseas No Change No Change

Pension risk

envisaged or by risks that we subsidiaries

currently believe are not material. 8. Regulatory & Policy risk Policy changes which could impact the Company’s No Change No Change

operations at large

Readers are also advised to Safety risk

exercise their own judgement 9. Failure to ensure containment of safety hazards (Behaviour, No Change No Change

Workplace, Process and Product) including containment of

in assessing the risks associated infectious diseases/impact of COVID-19

with the Company. Low

Low Medium High Approach to risk management Highlights of Enterprise Risk Risk management is embedded in the

Probability Over a number of years, the Company’s Management for FY 2021-22 day-to-day operations of each entity

Risk Management Framework has matured. In the context of: and operational managers are expected

The Framework identifies, prioritises, global economic and political to anticipate and react rapidly when

manages, monitors and reports both uncertainty circumstances change.

the key risks as well as the emerging Apart from Risk Management Committee

risks - that can impact achievement volatile growth dynamics and (RMC) and Senior Management providing

of your organisation’s objectives. The market cycles inputs on risks, continuous scanning of

Company’s Risk Management Framework increased sensitivity external environment is done to identify

is founded on sound organisation design expectations related to climate change new risks by the risk management

principles and is enabled by effective and team which are validated by the Senior

review mechanism. Risk Management at the imperatives of energy transition Management and RMC.

Tata Chemicals forms an integral part of

Management focus. We believe that effectively monitoring Deployment of best global practices on

and managing risks is key to achieving the risk management post benchmarking with

The Company has adopted an integrated Company’s strategic objectives. global companies.

Enterprise Risk Management (ERM)

framework which has been implemented Reviews held frequently with the An exercise to develop Business Continuity

across the organisation. It is developed by leadership team / business leaders on Plans (BCP) for TCL India’s major plant has

incorporating the best practices based on critical aspects related to safety, operations, recently been concluded. Development

COSO and ISO 31000 frameworks, suitably sustainability, evolving government of BCP at TCL India’s other plants and

customised to address the Company’s regulations, working capital management, corporate functions is also under progress.

unique business requirements. cyber-incidents, HR initiatives, etc.

30 31