Page 288 - Tata_Chemicals_yearly-reports-2021-22

P. 288

Integrated Annual Report 2021-22

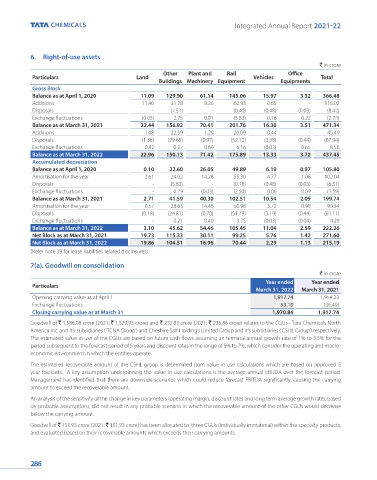

6. Right-of-use assets

` in crore

Other Plant and Rail Office

Particulars Land Vehicles Total

Buildings Machinery Equipment Equipments

Gross Block

Balance as at April 1, 2020 11.09 129.90 61.14 145.06 15.97 3.32 366.48

Additions 11.40 31.78 9.26 62.93 0.65 - 116.02

Disposals - (7.51) - (0.40) (0.48) (0.03) (8.42)

Exchange fluctuations (0.05) 2.75 0.01 (5.83) 0.16 0.22 (2.74)

Balance as at March 31, 2021 22.44 156.92 70.41 201.76 16.30 3.51 471.34

Additions 1.08 22.59 1.29 20.09 0.44 - 45.49

Disposals (1.38) (29.65) (0.97) (52.12) (3.38) (0.44) (87.94)

Exchange fluctuations 0.82 0.27 0.69 6.16 (0.03) 0.65 8.56

Balance as at March 31, 2022 22.96 150.13 71.42 175.89 13.33 3.72 437.45

Accumulated depreciation

Balance as at April 1, 2020 0.10 22.60 26.05 49.89 6.19 0.97 105.80

Amortisation for the year 2.61 24.02 14.28 55.30 4.77 1.06 102.04

Disposals - (5.82) - (0.18) (0.48) (0.03) (6.51)

Exchange fluctuations - 0.79 (0.03) (2.50) 0.06 0.09 (1.59)

Balance as at March 31, 2021 2.71 41.59 40.30 102.51 10.54 2.09 199.74

Amortisation for the year 0.57 28.63 14.46 50.98 3.72 0.98 99.34

Disposals (0.18) (24.81) (0.70) (51.79) (3.19) (0.44) (81.11)

Exchange fluctuations - 0.21 0.40 3.75 (0.03) (0.04) 4.29

Balance as at March 31, 2022 3.10 45.62 54.46 105.45 11.04 2.59 222.26

Net Block as at March 31, 2021 19.73 115.33 30.11 99.25 5.76 1.42 271.60

Net Block as at March 31, 2022 19.86 104.51 16.96 70.44 2.29 1.13 215.19

(Refer note 39 for lease liabilities related disclosures)

7(a). Goodwill on consolidation

` in crore

Year ended Year ended

Particulars

March 31, 2022 March 31, 2021

Opening carrying value as at April 1 1,917.74 1,954.23

Exchange fluctuations 53.10 (36.49)

Closing carrying value as at March 31 1,970.84 1,917.74

Goodwill of ` 1,586.08 crore (2021: ` 1,529.95 crore) and ` 232.83 crore (2021: ` 235.86 crore) relates to the CGUs - Tata Chemicals North

America Inc. and it’s subsidiaries (‘TCNA Group’) and Cheshire Salt Holdings Limited Group and it’s subsidiaries (‘CSHL Group’) respectively.

The estimated value in use of the CGUs are based on future cash flows assuming an terminal annual growth rate of 1% to 3.5% for the

period subsequent to the forecast period of 5 years and discount rates in the range of 5% to 7%, which consider the operating and macro-

economic environment in which the entities operate.

The estimated recoverable amount of the CSHL group is determined from value in use calculations which are based on approved 5

year forecasts. A key assumption underpinning the value in use calculations is the average annual EBITDA over the forecast period.

Management has identified that there are downside scenarios which could reduce forecast EBITDA significantly, causing the carrying

amount to exceed the recoverable amount.

An analysis of the sensitivity of the change in key parameters (operating margin, discount rates and long term average growth rate), based

on probable assumptions, did not result in any probable scenario in which the recoverable amount of the other CGUs would decrease

below the carrying amount.

Goodwill of ` 151.93 crore (2021: ` 151.93 crore) has been allocated to three CGUs (Individually immaterial) within the specialty products,

and evaluated based on their recoverable amounts which exceeds their carrying amounts.

286