Page 291 - Tata_Chemicals_yearly-reports-2021-22

P. 291

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

REPORT

STATEMENTS

REPORTS

Consolidated

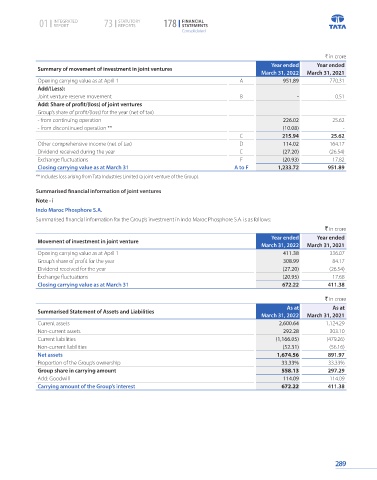

₹ in crore

Year ended Year ended

Summary of movement of investment in joint ventures

March 31, 2022 March 31, 2021

Opening carrying value as at April 1 A 951.89 770.31

Add/(Less):

Joint venture reserve movement B - 0.51

Add: Share of profit/(loss) of joint ventures

Group’s share of profit/(loss) for the year (net of tax)

- from continuing operation 226.02 25.62

- from discontinued operation ** (10.08) -

C 215.94 25.62

Other comprehensive income (net of tax) D 114.02 164.17

Dividend received during the year E (27.20) (26.54)

Exchange fluctuations F (20.93) 17.82

Closing carrying value as at March 31 A to F 1,233.72 951.89

** includes loss arising from Tata Industries Limited (a joint venture of the Group).

Summarised financial information of joint ventures

Note - i

Indo Maroc Phosphore S.A.

Summarised financial information for the Group’s investment in Indo Maroc Phosphore S.A. is as follows:

` in crore

Year ended Year ended

Movement of investment in joint venture

March 31, 2022 March 31, 2021

Opening carrying value as at April 1 411.38 336.07

Group’s share of profit for the year 308.99 84.17

Dividend received for the year (27.20) (26.54)

Exchange fluctuations (20.95) 17.68

Closing carrying value as at March 31 672.22 411.38

` in crore

As at As at

Summarised Statement of Assets and Liabilities

March 31, 2022 March 31, 2021

Current assets 2,600.64 1,124.29

Non-current assets 292.28 303.10

Current liabilities (1,166.05) (479.26)

Non-current liabilities (52.31) (56.16)

Net assets 1,674.56 891.97

Proportion of the Group’s ownership 33.33% 33.33%

Group share in carrying amount 558.13 297.29

Add: Goodwill 114.09 114.09

Carrying amount of the Group’s interest 672.22 411.38

289