Page 20 - Tata_Chemicals_yearly-reports-2021-22

P. 20

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

Integrated Annual Report 2021-22 REPORT REPORTS STATEMENTS

Strategy: Pursuing Growth

and Competitiveness

Focussed on Green Chemistry

Strategy: Pursuing Growth and Competitiveness

Focussed on Green Chemistry Strategic Objective 2 Focus Specialty Products on Green Chemistry

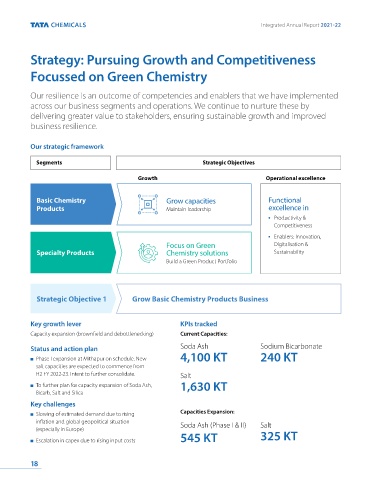

Our resilience is an outcome of competencies and enablers that we have implemented Key growth lever Key challenges

across our business segments and operations. We continue to nurture these by Focus on Green Chemistry Product Portfolio Impact on Agrochemicals demand due to high

delivering greater value to stakeholders, ensuring sustainable growth and improved Status and action plan inflation and seasonal uncertainties

business resilience. Silica: Commercialise Highly Dispersible Silica (HDS) and Long gestation period of product trials and

approvals in HDS and FOS

expand customer base. Further, focus on developing

Our strategic framework Specialty Silica grades for personal care and food. KPIs tracked

Fermentation Platform - Prebiotics & Formulations: Capacities: Customer acquisitions:

Segments Strategic Objectives Gaining increasing experience in Green Chemistry

Fermentation Platform. Obtained product and plant Silica Silica

Growth Operational excellence approvals with pharmaceutical and nutraceutical customers. 10.8 KT More than 100

Target to focus on new export markets and introduce

new formulations.

Basic Chemistry Grow capacities Functional FOS FOS

Products Maintain leadership excellence in 5 KT More than 50

Productivity &

Competitiveness

Enablers: Innovation,

Focus on Green Digitalisation &

Specialty Products Chemistry solutions Sustainability Driving Operational Excellence through Focussing on Key

Build a Green Product Portfolio Strategic Objective 3 Efficiency Levers

Efficiency lever Key challenges KPIs tracked

Functional excellence in productivity, cost Rising input costs mainly energy and materials Capacity utilisation:

Strategic Objective 1 Grow Basic Chemistry Products Business competitiveness and supply chain resilience

Supply chain challenges:

Mithapur - Soda Ash

Status and action plan Disrupted supplies caused by COVID

Key growth lever KPIs tracked Ongoing fixed cost optimisation plan at all pandemic and geopolitical situation 88%

Capacity expansion (brownfield and debottlenecking) Current Capacities: manufacturing facilities Limited alternatives to China for material

supply (mainly for Agrochemicals) Cuddalore - Silica

Status and action plan Soda Ash Sodium Bicarbonate Maximise capacity utilisation Shipment challenges - container and vessel 76%

Phase I expansion at Mithapur on schedule. New 4,100 KT 240 KT Efficient cash flow management across availability and congestion at ports

salt capacities are expected to commence from both Basic Chemistry and Specialty Rising cost of fuel and energy

H2 FY 2022-23. Intent to further consolidate. Salt Products businesses Mambattu - FOS

To further plan for capacity expansion of Soda Ash, 1,630 KT Supply chain resilience: 67%

Bicarb, Salt and Silica Reduce dependency on country / supplier

Key challenges Develop robust partner network

Slowing of estimated demand due to rising Capacities Expansion: Upstream and downstream integration

inflation and global geopolitical situation Soda Ash (Phase I & II) Salt Hedging of energy and raw material

(especially in Europe) Optimising logistics network

Escalation in capex due to rising input costs 545 KT 325 KT

18 19