Page 18 - Tata_Chemicals_yearly-reports-2021-22

P. 18

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

Integrated Annual Report 2021-22 REPORT REPORTS STATEMENTS

Using the Six Capitals

in Business Model to

Create Value

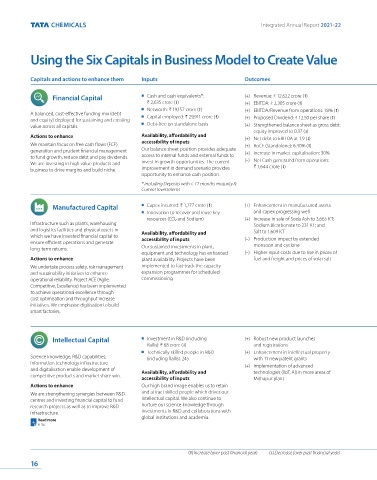

Using the Six Capitals in Business Model to Create Value

Capitals and actions to enhance them Inputs Outcomes Capitals and actions to enhance them Inputs Outcomes

Financial Capital Cash and cash equivalents*: (+) Revenue: ₹ 12,622 crore ( ) Human Capital Strong team of 4,642 people (+) High employee productivity, job

₹ 2,635 crore ( ) (+) EBITDA: ₹ 2,305 crore ( ) Training days per employee: satisfaction, engagement and retention

Networth: ₹ 19,157 crore ( ) (+) EBITDA/Revenue from operations: 18% ( ) 2.9 man-days ( ) (+) Zero incident of labour unrest

A balanced, cost-effective funding mix (debt Capital employed: ₹ 29,911 crore ( ) The knowledge, skills, experience and Safety training per employee: (+) Safety performance with Total

and equity) deployed for sustaining and creating (+) Proposed Dividend: ₹ 12.50 per share ( ) motivation of our employees help us 2.44 man-days ( ) Recordable Injury Frequency Rate of 1.43

value across all capitals. Debt-free on standalone basis (+) Strengthened balance sheet as gross debt: to create value.

equity improved to 0.37 ( ) (1.46 in FY 2020-21) ( )

Actions to enhance Availability, affordability and (+) Net debt to EBITDA at 1.9 ( ) Actions to enhance Availability, affordability and (–) 2 Unfortunate fatal incidents ( )

accessibility of inputs accessibility of inputs

We maintain focus on free cash flows (FCF) (+) RoCE (Standalone): 6.40% ( ) We are investing in building future-ready

generation and prudent financial management Our balance sheet position provides adequate (+) Increase in market capitalisation: 30% capabilities among people and in digital We have steady access of skilled labour at

to fund growth, reduce debt and pay dividends. access to internal funds and external funds to (–) Net Cash generated from operations: initiatives and niche skills. We are focussing our plants globally. We continue to train

We are investing in high value products and invest in growth opportunities. The current ₹ 1,644 crore ( ) on diversity and inclusion to foster creativity our people to build skills and provide them

business to drive margins and build niche. improvement in demand scenario provides and innovation. with various benefits to enhance retention

opportunity to enhance cash position. as well as attract new talent.

Read more

* including Deposits with < 12 months maturity & P. 43

Current Investments

Social and Relationship

Manufactured Capital Capex incurred: ₹ 1,277 crore ( ) (+) Enhancement in manufactured assets CSR spending* (standalone) – ₹ 15.88 crore ( ) (+) CSR beneficiaries: 3 lakh

Innovation to recover and reuse key and capex progressing well Capital Relationship management and collaborative (increase from 2 lakh) ( )

resources (CO2 and Sodium) (+) Increase in sale of Soda Ash to 3,665 KT; working with customers (+) Creating local employment opportunities

Infrastructure such as plants, warehousing Sodium Bicarbonate to 231 KT; and The collaborative relationships with the Positive engagement with trade unions in multiple regions of presence

and logistics facilities and physical assets in Availability, affordability and Salt to 1,609 KT communities, supply chain partners and (+) Maintained high customer

which we have invested financial capital to accessibility of inputs (–) Production impact by extended customers, along with our welfare initiatives, Continued engagement with and support satisfaction index

ensure efficient operations and generate monsoon and cyclone led to strengthening of our reputation of to supply chain partners to ensure effective

long-term returns. Our sustained investments in plant, being a long-term partner of choice and to service delivery (+) Multiple new customers added

equipment and technology has enhanced (–) Higher input costs due to rise in prices of (+) Enhancement in global

Actions to enhance plant availability. Projects have been fuel and freight and prices of solar salt secure licence to operate. Availability, affordability and supply chain network

We undertake process safety, risk management implemented to fast-track the capacity Actions to enhance accessibility of inputs (+) No regulatory implications or fines due

Stakeholder’s expectations are constantly

and sustainability initiatives to enhance expansion programmes for scheduled We are engaging with all stakeholders on a increasing in terms of the value we create to non-compliance. Paid taxes on time

operational reliability. Project ACE (Agile, commissioning. continual basis to address their needs. for them and determining their association (–) 1,019 complaints received

Competitive, Excellence) has been implemented Read more based on ESG performance. Our focus from customers

to achieve operational excellence through P. 50 on core value of ensuring safety of our

cost optimisation and throughput increase stakeholders, and serving them with

initiatives. We emphasise digitisation to build Integrity, Passion, Care and Excellence

smart factories. enables us to meet their expectations.

* Higher than our 2% commitment

Intellectual Capital Investment in R&D (including (+) Robust new product launches Natural Capital Resources used: (+) No serious environmental incidents or

Rallis): ₹ 68 crore ( ) and registrations Trona 52,93,597 MT ( ) material impact to biodiversity / habitats

Technically skilled people in R&D (+) Enhancement in intellectual property Solar Salt 25,99,410 MT ( ) (+) No water source negatively impacted by

Science knowledge, R&D capabilities, (including Rallis): 245 with 11 new patent grants The renewable and non-renewable natural our extraction

information technology infrastructure (+) Implementation of advanced resources that we use in our operations to Limestone 20,95,401 MT ( ) (+) Sustainable use of resources

and digitalisation enable development of Availability, affordability and technologies (IIoT, AI) in more areas of generate social and economic value and the Availability, affordability and (–) Increase in fresh water withdrawal from

competitive products and market share win. resultant environmental impacts.

accessibility of inputs Mithapur plant accessibility of inputs 2,614 Megalitres to 3,021 Megalitres

Actions to enhance Our high brand image enables us to retain Focus on Green Chemistry – Fermentation Our efforts in water management and (–) Increase in CO2 emission

We are strengthening synergies between R&D and attract skilled people which drives our platform for Prebiotics, Silica, etc. reuse, sodium and CO 2 recovery and energy (by 0.25 million MT to 4.38 million MT)

centres and investing financial capital to fund intellectual capital. We also continue to Actions to enhance efficiency (through renewable energy and

research projects as well as to improve R&D nurture our science knowledge through We have aligned our sustainability goals with operational efficiency) have significantly

infrastructure. investments in R&D and collaborations with Responsible Care, CORE and UN SDGs guidelines. reduced our dependence on natural

Read more global institutions and academia. We are strongly focussed on and investing in resources. We will continue to invest in these

P. 36 initiatives around carbon abatement, circular areas and in innovation.

economy and biodiversity protection.

Read more

P. 48

( )Increase (over past financial year) ( )Decrease (over past financial year) (+) Positive outcome (–) Negative outcome

16 17