Page 282 - Tata_Chemicals_yearly-reports-2020-2021

P. 282

Integrated Annual Report 2020-21

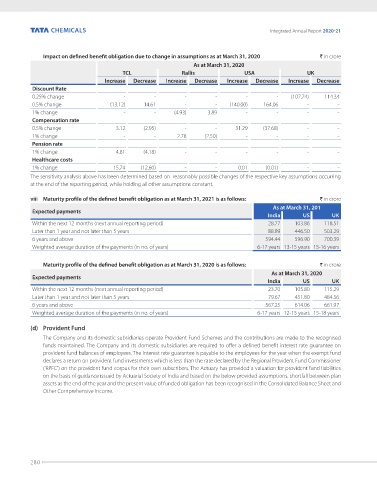

Impact on defined benefit obligation due to change in assumptions as at March 31, 2020 ` in crore

As at March 31, 2020

TCL Rallis USA UK

Increase Decrease Increase Decrease Increase Decrease Increase Decrease

Discount Rate

0.25% change - - - - - - (107.74) 114.34

0.5% change (13.12) 14.61 - - (140.00) 164.06 - -

1% change - - (4.93) 3.89 - - - -

Compensation rate

0.5% change 3.12 (2.95) - - 31.29 (37.68) - -

1% change - - 2.78 (2.50) - - - -

Pension rate

1% change 4.81 (4.18) - - - - - -

Healthcare costs

1% change 15.74 (12.60) - - 0.01 (0.01) - -

The sensitivity analysis above has been determined based on reasonably possible changes of the respective key assumptions occurring

at the end of the reporting period, while holding all other assumptions constant.

viii Maturity profile of the defined benefit obligation as at March 31, 2021 is as follows: ` in crore

As at March 31, 201

Expected payments

India US UK

Within the next 12 months (next annual reporting period) 28.77 103.86 118.51

Later than 1 year and not later than 5 years 88.89 446.50 503.29

6 years and above 594.44 596.90 700.39

Weighted average duration of the payments (in no. of years) 6-17 years 13-15 years 15-16 years

Maturity profile of the defined benefit obligation as at March 31, 2020 is as follows: ` in crore

As at March 31, 2020

Expected payments

India US UK

Within the next 12 months (next annual reporting period) 23.70 105.80 115.29

Later than 1 year and not later than 5 years 79.67 451.80 484.56

6 years and above 567.25 614.06 661.97

Weighted average duration of the payments (in no. of years) 6-17 years 12-15 years 15-18 years

(d) Provident Fund

The Company and its domestic subsidiaries operate Provident Fund Schemes and the contributions are made to the recognised

funds maintained. The Company and its domestic subsidiaries are required to offer a defined benefit interest rate guarantee on

provident fund balances of employees. The interest rate guarantee is payable to the employees for the year when the exempt fund

declares a return on provident fund investments which is less than the rate declared by the Regional Provident Fund Commissioner

('RPFC') on the provident fund corpus for their own subscribers. The Actuary has provided a valuation for provident fund liabilities

on the basis of guidance issued by Actuarial Society of India and based on the below provided assumptions, shortfall between plan

assets as the end of the year and the present value of funded obligation has been recognised in the Consolidated Balance Sheet and

Other Comprehensive Income.

280