Page 279 - Tata_Chemicals_yearly-reports-2020-2021

P. 279

Integrated Report Statutory Reports Financial Statements

1-59 60-146 Consolidated

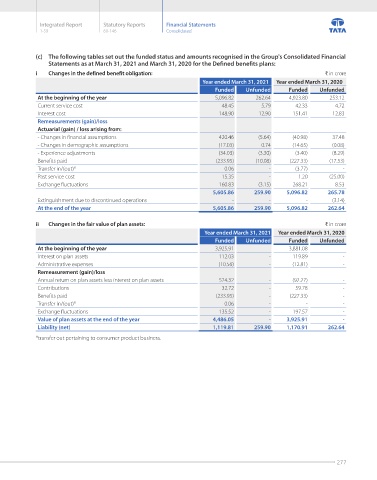

(c) The following tables set out the funded status and amounts recognised in the Group's Consolidated Financial

Statements as at March 31, 2021 and March 31, 2020 for the Defined benefits plans:

i Changes in the defined benefit obligation: ` in crore

Year ended March 31, 2021 Year ended March 31, 2020

Funded Unfunded Funded Unfunded

At the beginning of the year 5,096.82 262.64 4,923.80 253.12

Current service cost 48.45 5.79 42.33 4.72

Interest cost 148.90 12.90 151.41 12.83

Remeasurements (gain)/loss

Actuarial (gain) / loss arising from:

- Changes in financial assumptions 420.46 (5.64) (40.98) 37.48

- Changes in demographic assumptions (17.03) 0.74 (14.65) (0.08)

- Experience adjustments (34.03) (3.30) (3.40) (8.29)

Benefits paid (233.95) (10.08) (227.33) (17.53)

Transfer in/(out)* 0.06 - (3.77) -

Past service cost 15.35 - 1.20 (25.00)

Exchange fluctuations 160.83 (3.15) 268.21 8.53

5,605.86 259.90 5,096.82 265.78

Extinguishment due to discontinued operations - - - (3.14)

At the end of the year 5,605.86 259.90 5,096.82 262.64

ii Changes in the fair value of plan assets: ` in crore

Year ended March 31, 2021 Year ended March 31, 2020

Funded Unfunded Funded Unfunded

At the beginning of the year 3,925.91 - 3,881.08 -

Interest on plan assets 112.03 - 119.89 -

Administrative expenses (10.56) - (12.81) -

Remeasurement (gain)/loss

Annual return on plan assets less interest on plan assets 524.32 - (92.27) -

Contributions 32.72 - 59.78 -

Benefits paid (233.95) - (227.33) -

Transfer in/(out)* 0.06 - - -

Exchange fluctuations 135.52 - 197.57 -

Value of plan assets at the end of the year 4,486.05 - 3,925.91 -

Liability (net) 1,119.81 259.90 1,170.91 262.64

*transfer out pertaining to consumer product business.

277