Page 287 - Tata_Chemicals_yearly-reports-2020-2021

P. 287

Integrated Report Statutory Reports Financial Statements

1-59 60-146 Consolidated

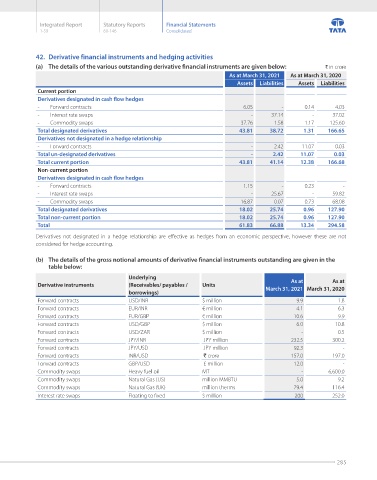

42. Derivative financial instruments and hedging activities

(a) The details of the various outstanding derivative financial instruments are given below: ` in crore

As at March 31, 2021 As at March 31, 2020

Assets Liabilities Assets Liabilities

Current portion

Derivatives designated in cash flow hedges

- Forward contracts 6.05 - 0.14 4.03

- Interest rate swaps - 37.14 - 37.02

- Commodity swaps 37.76 1.58 1.17 125.60

Total designated derivatives 43.81 38.72 1.31 166.65

Derivatives not designated in a hedge relationship

- Forward contracts - 2.42 11.07 0.03

Total un-designated derivatives - 2.42 11.07 0.03

Total current portion 43.81 41.14 12.38 166.68

Non-current portion

Derivatives designated in cash flow hedges

- Forward contracts 1.15 - 0.23 -

- Interest rate swaps - 25.67 - 59.82

- Commodity swaps 16.87 0.07 0.73 68.08

Total designated derivatives 18.02 25.74 0.96 127.90

Total non-current portion 18.02 25.74 0.96 127.90

Total 61.83 66.88 13.34 294.58

Derivatives not designated in a hedge relationship are effective as hedges from an economic perspective, however these are not

considered for hedge accounting.

(b) The details of the gross notional amounts of derivative financial instruments outstanding are given in the

table below:

Underlying

As at

As at

Derivative instruments (Receivables/ payables / Units March 31, 2021 March 31, 2020

borrowings)

Forward contracts USD/INR $ million 9.9 1.8

Forward contracts EUR/INR € million 4.1 6.3

Forward contracts EUR/GBP € million 10.6 9.9

Forward contracts USD/GBP $ million 6.0 10.8

Forward contracts USD/ZAR $ million - 0.5

Forward contracts JPY/INR JPY million 232.5 300.2

Forward contracts JPY/USD JPY million 92.3 -

Forward contracts INR/USD ` crore 157.0 197.0

Forward contracts GBP/USD £ million 12.0 -

Commodity swaps Heavy fuel oil MT - 6,600.0

Commodity swaps Natural Gas (US) million MMBTU 5.0 9.2

Commodity swaps Natural Gas (UK) million therms 79.4 116.4

Interest rate swaps Floating to fixed $ million 200 252.0

285