Page 276 - Tata_Chemicals_yearly-reports-2020-2021

P. 276

Integrated Annual Report 2020-21

for striking off its name from the register of companies w.e.f March 29, 2021. Accordingly, RCEL has ceased to be a subsidiary of the

Group effective the said date.

(iv) The Hon’ble National Company Law Tribunal (NCLT), Bengaluru Bench and the NCLT, Mumbai Bench have approved the Scheme

of Merger by Absorption of Metahelix Life Sciences Limited (WOS of Rallis) with Rallis India Limited (‘Scheme’) from the Appointed

Date of April 1, 2019. The Effective Date of the Scheme is February 1, 2020. Accordingly, Metahelix has ceased to be a subsidiary of

the Company with effect from February 1, 2020. There is no impact of this transaction on the Consolidated Financial Statements.

(v) The NCLT, Mumbai Bench also approved the Scheme of Amalgamation of Zero Waste Agro Organics Limited (WOS of Rallis) with

Rallis India Limited (‘Scheme’) on February 22, 2020 from the Appointed Date of April 1, 2017. The Effective Date of the Scheme is July

9, 2020. Accordingly, Zero Waste has ceased to be a subsidiary of the Company with effect from July 9, 2020. There is no impact of

this transaction on the Consolidated Financial Statements.

(vi) The Hon'ble National Company Law Tribunal ('NCLT'), Mumbai Bench on April 23, 2020 approved the Scheme of Merger by Absorption

of Bio Energy Venture-1 (Mauritius) Pvt. Ltd. ('Bio'), a wholly owned subsidiary of the Company, with the Company ('Scheme'), with an

Appointed Date of April 1 2019. The Registrar of Companies at Mauritius removed the name of Bio from the register of companies

w.e.f. June 1, 2020 and accordingly, Bio has ceased to be a subsidiary of the Company with effect from June 1, 2020. Consequent to

this, TCIPL has become a direct wholly owned subsidiary of the Company with effect from that date. There is no impact of the merger

in the Consolidated Financial Statements.

(vii) During the year, PT Metahelix Life Sciences Indonesia, a subsidiary of Rallis, received approval for the cancellation of its Company

Registration Number and revocation of its business license w.e.f March 19, 2021. Further, an application for cancellation of its Tax

Identification Number has been made and the approval for the same is awaited.

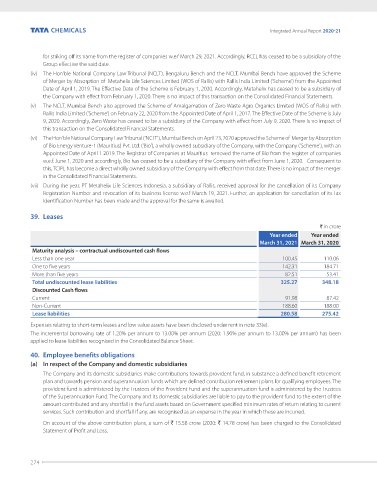

39. Leases

` in crore

Year ended Year ended

March 31, 2021 March 31, 2020

Maturity analysis – contractual undiscounted cash flows

Less than one year 100.45 110.06

One to five years 142.31 184.71

More than five years 82.51 53.41

Total undiscounted lease liabilities 325.27 348.18

Discounted Cash flows

Current 91.98 87.42

Non-Current 188.60 188.00

Lease liabilities 280.58 275.42

Expenses relating to short-term leases and low value assets have been disclosed under rent in note 33(e).

The incremental borrowing rate of 1.20% per annum to 13.00% per annum (2020: 1.90% per annum to 13.00% per annum) has been

applied to lease liabilities recognised in the Consolidated Balance Sheet.

40. Employee benefits obligations

(a) In respect of the Company and domestic subsidiaries

The Company and its domestic subsidiaries make contributions towards provident fund, in substance a defined benefit retirement

plan and towards pension and superannuation funds which are defined contribution retirement plans for qualifying employees. The

provident fund is administered by the Trustees of the Provident Fund and the superannuation fund is administered by the Trustees

of the Superannuation Fund. The Company and its domestic subsidiaries are liable to pay to the provident fund to the extent of the

amount contributed and any shortfall in the fund assets based on Government specified minimum rates of return relating to current

services. Such contribution and shortfall if any, are recognised as an expense in the year in which these are incurred.

On account of the above contribution plans, a sum of ` 15.58 crore (2020: ` 14.78 crore) has been charged to the Consolidated

Statement of Profit and Loss.

274