Page 271 - Tata_Chemicals_yearly-reports-2020-2021

P. 271

Integrated Report Statutory Reports Financial Statements

1-59 60-146 Consolidated

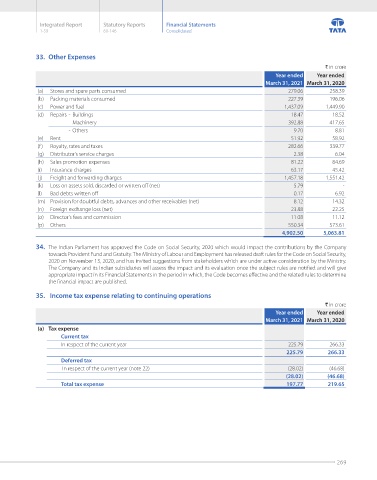

33. Other Expenses

` in crore

Year ended Year ended

March 31, 2021 March 31, 2020

(a) Stores and spare parts consumed 279.06 258.39

(b) Packing materials consumed 227.39 196.06

(c) Power and fuel 1,437.09 1,449.90

(d) Repairs - Buildings 18.47 18.52

- Machinery 392.88 417.65

- Others 9.70 8.81

(e) Rent 51.92 58.92

(f) Royalty, rates and taxes 282.66 339.77

(g) Distributor's service charges 2.38 6.04

(h) Sales promotion expenses 81.22 84.69

(i) Insurance charges 63.17 45.42

(j) Freight and forwarding charges 1,457.18 1,551.42

(k) Loss on assets sold, discarded or written off (net) 5.79 -

(l) Bad debts written off 0.17 6.92

(m) Provision for doubtful debts, advances and other receivables (net) 8.12 14.32

(n) Foreign exchange loss (net) 23.88 22.25

(o) Director's fees and commission 11.08 11.12

(p) Others 550.34 573.61

4,902.50 5,063.81

34. The Indian Parliament has approved the Code on Social Security, 2020 which would impact the contributions by the Company

towards Provident Fund and Gratuity. The Ministry of Labour and Employment has released draft rules for the Code on Social Security,

2020 on November 13, 2020, and has invited suggestions from stakeholders which are under active consideration by the Ministry.

The Company and its Indian subsidiaries will assess the impact and its evaluation once the subject rules are notified and will give

appropriate impact in its Financial Statements in the period in which, the Code becomes effective and the related rules to determine

the financial impact are published.

35. Income tax expense relating to continuing operations

` in crore

Year ended Year ended

March 31, 2021 March 31, 2020

(a) Tax expense

Current tax

In respect of the current year 225.79 266.33

225.79 266.33

Deferred tax

In respect of the current year (note 22) (28.02) (46.68)

(28.02) (46.68)

Total tax expense 197.77 219.65

269