Page 262 - Tata_Chemicals_yearly-reports-2020-2021

P. 262

Integrated Annual Report 2020-21

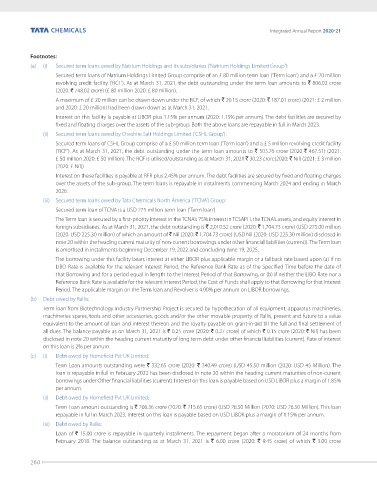

Footnotes:

(a) (i) Secured term loans owed by Natrium Holdings and its subsidiaries ('Natrium Holdings Limited Group'):

Secured term loans of Natrium Holdings Limited Group comprise of an £ 80 million term loan ('Term loan') and a £ 20 million

revolving credit facility ('RCF'). As at March 31, 2021, the debt outstanding under the term loan amounts to ` 806.02 crore

(2020: ` 748.02 crore) (£ 80 million 2020: £ 80 million).

A maximum of £ 20 million can be drawn down under the RCF, of which ` 20.15 crore (2020: ` 187.01 crore) (2021: £ 2 million

and 2020: £ 20 million) had been drawn down as at March 31, 2021.

Interest on this facility is payable at LIBOR plus 1.15% per annum (2020: 1.15% per annum). The debt facilities are secured by

fixed and floating charges over the assets of the sub-group. Both the above loans are repayable in full in March 2023.

(ii) Secured term loans owed by Cheshire Salt Holdings Limited ('CSHL Group'):

Secured term loans of CSHL Group comprise of a £ 50 million term loan ('Term loan') and a £ 5 million revolving credit facility

('RCF'). As at March 31, 2021, the debt outstanding under the term loan amounts to ` 503.76 crore (2020 ` 467.51) (2021:

£ 50 million 2020: £ 50 million). The RCF is utilised/outstanding as at March 31, 2021 ` 30.23 crore(2020: ` Nil) (2021: £ 3 million

(2020: £ Nil))

Interest on these facilities is payable at RFR plus 2.45% per annum. The debt facilities are secured by fixed and floating charges

over the assets of the sub-group. The term loans is repayable in instalments commencing March 2024 and ending in March

2026.

(iii) Secured term loans owed by Tata Chemicals North America ('TCNA') Group:

Secured term loan of TCNA is a USD 275 million term loan ('Term loan')

The Term loan is secured by a first-priority interest in the TCNA’s 75% interest in TCSAPH, the TCNA’s assets, and equity interest in

foreign subsidiaries. As at March 31, 2021, the debt outstanding is ` 2,010.52 crore (2020: ` 1,704.73 crore) (USD 275.00 million

(2020: USD 225.30 million) of which an amount of ` Nil (2020: ` 1,704.73 crore) (USD Nil (2020: USD 225.30 million) disclosed in

note 20 within the heading current maturity of non-current borrowings under other financial liabilities (current)). The Term loan

is amortised in installments beginning December 19, 2022 and concluding June 19, 2025.

The borrowing under this facility bears interest at either LIBOR plus applicable margin or a fallback rate based upon (a) if no

LIBO Rate is available for the relevant Interest Period, the Reference Bank Rate as of the Specified Time before the date of

that Borrowing and for a period equal in length to the Interest Period of that Borrowing, or (b) if neither the LIBO Rate nor a

Reference Bank Rate is available for the relevant Interest Period, the Cost of Funds shall apply to that Borrowing for that Interest

Period. The applicable margin on the Term loan and Revolver is 4.00% per annum on LIBOR borrowings.

(b) Debt owed by Rallis:

Term loan from Biotechnology Industry Partnership Project is secured by hypothecation of all equipment, apparatus machineries,

machineries spares, tools and other accessories, goods and/or the other movable property of Rallis, present and future to a value

equivalent to the amount of loan and interest thereon and the royalty payable on grant-in-aid till the full and final settlement of

all dues. The balance payable as on March 31, 2021 is ` 0.25 crore (2020: ` 0.27 crore) of which ` 0.15 crore (2020: ` Nil) has been

disclosed in note 20 within the heading current maturity of long term debt under other financial liabilities (current). Rate of interest

on this loan is 2% per annum.

(c) (i) Debt owed by Homefield Pvt UK Limited:

Term Loan amounts outstanding were ` 332.65 crore (2020: ` 340.49 crore) (USD 45.50 million (2020: USD 45 Million). The

loan is repayable in full in February 2022 has been disclosed in note 20 within the heading current maturities of non-current

borrowings under Other financial liabilities (current). Interest on this loan is payable based on USD LIBOR plus a margin of 1.85%

per annum.

(ii) Debt owed by Homefield Pvt UK Limited:

Term Loan amount outstanding is ` 208.36 crore (2020: ` 215.65 crore) (USD 28.50 Million (2020: USD 28.50 Million). This loan

repayable in full in March 2023. Interest on this loan is payable based on USD LIBOR plus a margin of 1.15% per annum.

(iii) Debt owed by Rallis:

Loan of ` 15.00 crore is repayable in quarterly installments. The repayment began after a moratorium of 24 months from

February 2018. The balance outstanding as at March 31, 2021 is ` 6.00 crore (2020: ` 9.45 crore) of which ` 3.00 crore

260