Page 250 - Tata_Chemicals_yearly-reports-2020-2021

P. 250

Integrated Annual Report 2020-21

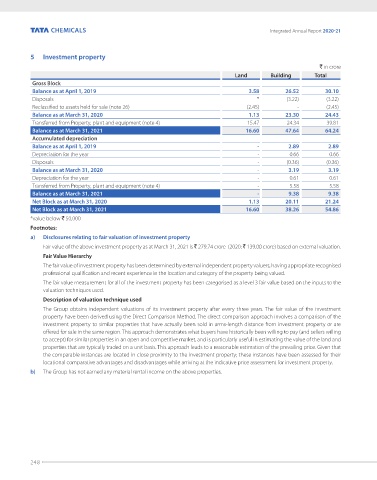

5 Investment property

` in crore

Land Building Total

Gross Block

Balance as at April 1, 2019 3.58 26.52 30.10

Disposals * (3.22) (3.22)

Reclassified to assets held for sale (note 26) (2.45) - (2.45)

Balance as at March 31, 2020 1.13 23.30 24.43

Transferred from Property, plant and equipment (note 4) 15.47 24.34 39.81

Balance as at March 31, 2021 16.60 47.64 64.24

Accumulated depreciation

Balance as at April 1, 2019 - 2.89 2.89

Depreciation for the year - 0.66 0.66

Disposals - (0.36) (0.36)

Balance as at March 31, 2020 - 3.19 3.19

Depreciation for the year - 0.61 0.61

Transferred from Property, plant and equipment (note 4) - 5.58 5.58

Balance as at March 31, 2021 - 9.38 9.38

Net Block as at March 31, 2020 1.13 20.11 21.24

Net Block as at March 31, 2021 16.60 38.26 54.86

*value below ` 50,000

Footnotes:

a) Disclosures relating to fair valuation of investment property

Fair value of the above investment property as at March 31, 2021 is ` 279.74 crore (2020: ` 139.00 crore) based on external valuation.

Fair Value Hierarchy

The fair value of investment property has been determined by external independent property valuers, having appropriate recognised

professional qualification and recent experience in the location and category of the property being valued.

The fair value measurement for all of the investment property has been categorised as a level 3 fair value based on the inputs to the

valuation techniques used.

Description of valuation technique used

The Group obtains independent valuations of its investment property after every three years. The fair value of the investment

property have been derived using the Direct Comparison Method. The direct comparison approach involves a comparison of the

investment property to similar properties that have actually been sold in arms-length distance from investment property or are

offered for sale in the same region. This approach demonstrates what buyers have historically been willing to pay (and sellers willing

to accept) for similar properties in an open and competitive market, and is particularly useful in estimating the value of the land and

properties that are typically traded on a unit basis. This approach leads to a reasonable estimation of the prevailing price. Given that

the comparable instances are located in close proximity to the investment property; these instances have been assessed for their

locational comparative advantages and disadvantages while arriving at the indicative price assessment for investment property.

b) The Group has not earned any material rental income on the above properties.

248