Page 320 - Tata_Chemicals_yearly-reports-2019-20

P. 320

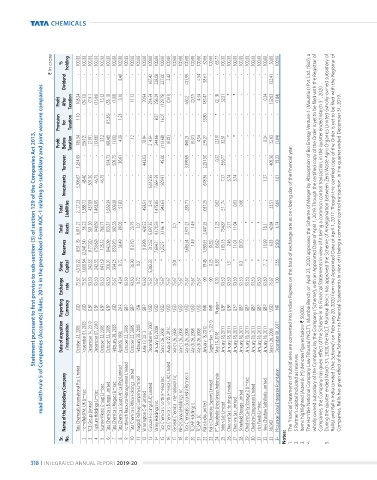

` in crore % holding 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 50.06 100.00 65.77 100.00 100.00 100.00 100.00 100.00 100.00 100.00 100.00 50.00 100.00

Dividend - - - - - - - 8.48 - - - - 167.42 228.08 227.00 2.42 - - 453.99 - 4.54 58.61 - - - - - - - - - - 132.41 -

read with rule 5 of Companies (Accounts) Rules, 2014 in the prescribed Form AOC-1 relating to subsidiary and joint venture companies

Profit After Taxation 105.24 (59.12) (7.91) (13.66) 13.12 (53.10) (1.00) 3.16 - 11.12 - 70.94 214.54 236.29 (129.75) (0.01) - - 460.21 (0.37) 4.54 185.47 - (2.19) 32.51 * * - - - - 0.34 132.63 (1.84)

Provision for Taxation 1.10 - - - - (15.36) - 1.23 - - - - - 8.37 16.07 - - - - - - 53.80 - * - - - - - - - - - -

Statement pursuant to first proviso to sub-section (3) of section 129 of the Companies Act 2013,

Profit Before Taxation 106.34 (59.12) (7.91) (13.66) 13.12 (68.46) (1.00) 4.39 - 11.12 - 70.94 214.54 244.66 (113.68) (0.01) - - 460.21 (0.37) 4.54 239.27 - (2.19) 32.51 * * - - - - 0.34 132.63 (1.84)

Turnover 1,254.05 - - - - 874.73 505.75 136.61 - - - 443.03 - - 45.00 - - - 3,399.69 - - 2,251.50 - 0.32 356.77 - - - - - - - 405.30 15.23

Investments 5,306.67 45.40 501.50 46.75 46.75 - - - - - - - 5,612.35 7,664.59 1,929.91 - - - - - - 678.36 - - 7.17 3.74 3.74 - - - - 1.37 - 1.01

Total Liabilities 2,127.23 1,388.72 437.09 1,463.05 - 1,569.39 609.28 57.82 - - - 458.51 2.40 1,475.85 1,943.63 - - - 1,285.71 - - 1,037.25 - 0.02 571.74 - 0.03 0.06 - - - - 33.51 6.69

Total Assets 6,011.27 56.22 501.50 948.69 766.71 833.37 392.56 89.03 * 23.75 0.01 438.52 5,697.35 9,170.56 3,196.14 - 0.01 * 2,971.25 1.49 - 2,447.25 - 1.23 754.87 3.77 11.04 - * * * 18.11 42.84 6.74

Reserves (631.18) (2,341.34) (177.92) (756.69) 125.12 (942.09) (550.97) 30.49 - (13.15) - (19.99) 312.62 7,694.71 1,252.51 - - - 1,685.54 1.49 - 1,390.55 (0.25) (5.62) 183.13 2.46 11.01 (0.07) - - - 10.99 9.33 (2.50) the Hon’ble national Company law tribunal (‘nClt’), Mumbai Bench on april 23, 2020 approved the Scheme of Merger by absorption of Bio energy Venture-1 (Mauritius) pvt. ltd. (‘Bio’), a wholly owned

Share Capital 4,515.22 1,008.84 242.33 242.33 641.59 206.07 334.25 0.72 * 36.90 0.01 - 5,382.33 * * - 0.01 * - - - 19.45 0.25 6.83 * 1.31 * 0.01 * * * 7.12 - 2.55 Companies, the Company has given effect of the Scheme in its Financial Statements in view of it being a common control transaction, in the quarter ended March 31, 2020 Companies, rallis has given effect of the Scheme in its Financial Statements in vie

Exchange rate 75.67 75.67 93.50 93.50 93.50 93.50 75.67 4.24 93.50 93.50 0.72 93.50 75.67 75.67 75.67 75.67 75.67 75.67 75.67 75.67 75.67 1.00 1.00 0.00 93.50 93.50 93.50 93.50 93.50 93.50 93.50 93.50 75.67 1.00 the Financial Statements of subsidiaries are converted into Indian rupees on the basis of exchange rate as on closing day of the financial year.

Reporting Currency uSd uSd gBp gBp gBp gBp uSd Zar gBp gBp KSH gBp uSd uSd uSd uSd uSd uSd uSd uSd uSd Inr Inr rupiah gBp gBp gBp gBp gBp gBp gBp gBp uSd Inr

Date of acqusition / incorporation october 23, 2005 november 01, 2005 december 14, 2010 december 07, 2010 october 22, 2005 october 22, 2005 February 28, 2005 april 09, 1996 october 22, 2005 october 22, 2005 February 28, 2005 June 13, 2013 december 04, 2007 January 30, 2008 March 26, 2008 august 22, 2014 March 26, 2008 March 26, 2008 March 26, 2008 March 26, 2008 March 26, 2008 January 18, 2012 September 15, 2010 May 19, 2

Name of the Subsidiary Company tata Chemicals International pte. limited Homefield pvt. uK limited tCe group limited natrium Holdings limited Brunner Mond group limited tata Chemicals europe limited tata Chemicals Magadi limited tata Chemicals South africa (pty) limited northwich resource Management limited tata Chemicals africa Holdings limited Magadi railway Company limited Winnington CHp limited gusiute Holdings (uK) limited Valley H

Sr. No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 tCSap llC 21 22 23 24 25 26 27 28 29 30 31 32 alCad 33 34 Notes: 1. 2. 3. 4. 5.

318 I Integrated annual report 2019-20