Page 317 - Tata_Chemicals_yearly-reports-2019-20

P. 317

Integrated report Statutory reportS Financial StatementS

Consolidated

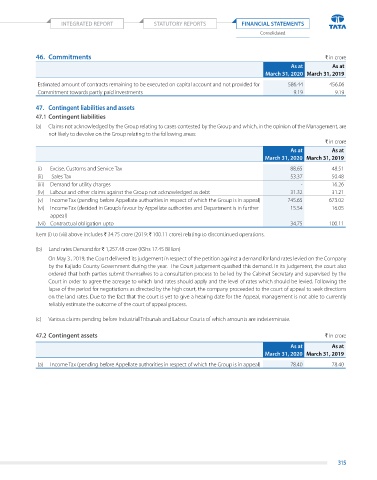

46. Commitments ` in crore

As at As at

March 31, 2020 March 31, 2019

estimated amount of contracts remaining to be executed on capital account and not provided for 586.44 456.06

Commitment towards partly paid investments 9.19 9.19

47. Contingent liabilities and assets

47.1 Contingent liabilities

(a) Claims not acknowledged by the group relating to cases contested by the group and which, in the opinion of the Management, are

not likely to devolve on the group relating to the following areas:

` in crore

As at As at

March 31, 2020 March 31, 2019

(i) excise, Customs and Service tax 88.65 48.51

(ii) Sales tax 53.37 50.48

(iii) demand for utility charges - 16.26

(iv) labour and other claims against the group not acknowledged as debt 31.32 31.21

(v) Income tax (pending before appellate authorities in respect of which the group is in appeal) 745.65 673.02

(vi) Income tax (decided in group’s favour by appellate authorities and department is in further 15.54 16.05

appeal)

(vii) Contractual obligation upto 34.75 100.11

Item (i) to (vii) above includes ` 34.75 crore (2019: ` 100.11 crore) relating to discontinued operations.

(b) land rates demand for ` 1,257.48 crore (KShs 17.45 Billion)

on May 3 , 2019, the Court delivered its judgement in respect of the petition against a demand for land rates levied on the Company

by the Kajiado County government during the year. the Court judgement quashed this demand. In its judgement, the court also

ordered that both parties submit themselves to a consultation process to be led by the Cabinet Secretary and supervised by the

Court in order to agree the acreage to which land rates should apply and the level of rates which should be levied. Following the

lapse of the period for negotiations as directed by the high court, the company proceeded to the court of appeal to seek directions

on the land rates. due to the fact that the court is yet to give a hearing date for the appeal, management is not able to currently

reliably estimate the outcome of the court of appeal process.

(c) Various claims pending before Industrial tribunals and labour Courts of which amounts are indeterminate.

47.2 Contingent assets ` in crore

As at As at

March 31, 2020 March 31, 2019

(a) Income tax (pending before appellate authorities in respect of which the group is in appeal) 78.40 78.40

315