Page 236 - Tata_Chemicals_yearly-reports-2017-18

P. 236

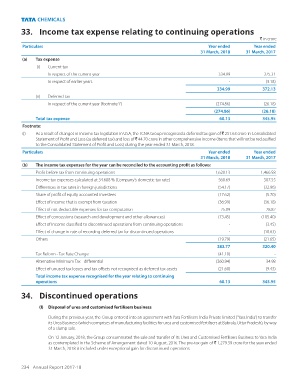

33. Income tax expense relating to continuing operations

` in crore

Particulars Year ended Year ended

31 March, 2018 31 March, 2017

(a) Tax expense

(i) Current tax

In respect of the current year 334.99 375.31

In respect of earlier years - (3.18)

334.99 372.13

(ii) Deferred tax

In respect of the current year (footnote ‘i’) (274.86) (26.18)

(274.86) (26.18)

Total tax expense 60.13 345.95

Footnote:

(i) As a result of changes in income tax legislation in USA, the TCNA Group recognised a deferred tax gain of ` 251.63 crore in Consolidated

Statement of Profit and Loss (as deferred tax) and loss of ` 44.70 crore in other comprehensive income (Items that will not be reclassified

to the Consolidated Statement of Profit and Loss) during the year ended 31 March, 2018.

Particulars Year ended Year ended

31 March, 2018 31 March, 2017

(b) The income tax expenses for the year can be reconciled to the accounting profit as follows:

Profit before tax from continuing operations 1,620.13 1,466.58

Income tax expenses calculated at 34.608 % (Company’s domestic tax rate) 560.69 507.55

Differences in tax rates in foreign jurisdictions (54.17) (32.96)

Share of profit of equity accounted investees (17.62) (5.70)

Effect of income that is exempt from taxation (36.99) (36.18)

Effect of not deductible expenses for tax computation 25.09 28.82

Effect of concessions (research and development and other allowances) (73.45) (105.40)

Effect of Income classified to discontinued operations from continuing operations - (3.45)

Effect of change in rate of recording deferred tax for discontinued operations - (10.63)

Others (19.79) (21.65)

383.77 320.40

Tax Reform - Tax Rate Change (41.10) -

Alternative Minimum Tax - differential (260.94) 34.98

Effect of unused tax losses and tax offsets not recognised as deferred tax assets (21.60) (9.43)

Total income tax expense recognised for the year relating to continuing

operations 60.13 345.95

34. Discontinued operations

(I) Disposal of urea and customised fertilisers business

During the previous year, the Group entered into an agreement with Yara Fertilisers India Private limited (‘Yara India’) to transfer

its Urea Business (which comprises of manufacturing facilities for urea and customised fertilisers at Babrala, Uttar Pradesh), by way

of a slump sale.

On 12 January, 2018, the Group consummated the sale and transfer of its Urea and Customised Fertilisers Business to Yara India

as contemplated in the Scheme of Arrangement dated 10 August, 2016. The pre-tax gain of ` 1,279.39 crore for the year ended

31 March, 2018 is included under exceptional gain for discontinued operations.

234 Annual Report 2017-18