Page 231 - Tata_Chemicals_yearly-reports-2017-18

P. 231

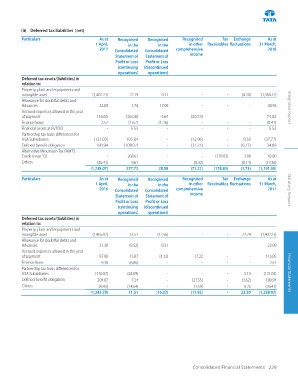

(ii) Deferred tax liabilities (net)

Particulars As at Recognised Recognised Recognised Tax Exchange As at

1 April, in the in the in other Receivables fluctuations 31 March,

2017 Consolidated Consolidated comprehensive 2018

Statement of Statement of income

Profit or Loss Profit or Loss

(continuing (discontinued

operations) operations)

Deferred tax assets/(liabilities) in

relation to:

Property, plant and equipments and

intangible asset (1,402.23) 22.19 0.11 - - (4.24) (1,384.17)

Allowance for doubtful debts and

Advances 22.09 1.74 17.09 - - - 40.92 Integrated Report

Accrued expenses allowed in the year

of payment 116.05 (26.08) 4.64 (20.59) - - 74.02

Finance lease 2.52 (1.67) (1.26) - - - (0.41)

Financial assets at FVTOCI - 5.53 - - - - 5.53

Partnership tax basis differences for

USA Subsidiaries (131.03) 105.84 - (12.96) - 0.38 (37.77)

Defined benefit obligation 180.94 (108.07) - (37.25) - (0.73) 34.89

Alternative Minumum Tax ('AMT')

Credit (note 33) - 268.63 - - (178.83) 3.00 92.80

Others (26.41) 9.61 - (0.42) - (0.14) (17.36)

(1,238.07) 277.72 20.58 (71.22) (178.83) (1.73) (1,191.55)

Particulars As at Recognised Recognised Recognised Tax Exchange As at

1 April, in the in the in other Receivables fluctuations 31 March,

2016 Consolidated Consolidated comprehensive 2017 Statutory Reports

Statement of Statement of income

Profit or Loss Profit or Loss

(continuing (discontinued

operations) operations)

Deferred tax assets/(liabilities) in

relation to:

Property, plant and equipments and

intangible asset (1,465.92) 53.51 (12.56) - - 22.74 (1,402.23)

Allowance for doubtful debts and

Advances 31.30 (9.52) 0.31 - - - 22.09

Accrued expenses allowed in the year

of payment 87.08 15.87 (4.12) 17.22 - - 116.05

Finance lease 9.38 (6.86) - - - - 2.52

Partnership tax basis differences for

USA Subsidiaries (110.07) (24.09) - - - 3.13 (131.03) Financial Statements

Defined benefit obligation 204.87 7.24 - (27.55) - (3.62) 180.94

Others (0.43) (24.64) - (1.59) - 0.25 (26.41)

(1,243.79) 11.51 (16.37) (11.92) - 22.50 (1,238.07)

Consolidated Financial Statements 229