Page 184 - Tata_Chemicals_yearly-reports-2017-18

P. 184

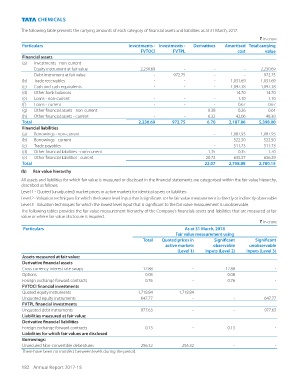

The following table presents the carrying amounts of each category of financial assets and liabilities as at 31 March, 2017.

` in crore

Particulars Investments - Investments - Derivatives Amortised Total carrying

FVTOCI FVTPL cost value

Financial assets

(a) Investments - non-current

Equity instrument at fair value 2,230.69 - - - 2,230.69

Debt instrument at fair value - 972.75 - - 972.75

(b) Trade receivables - - - 1,031.69 1,031.69

(c) Cash and cash equivalents - - - 1,097.38 1,097.38

(d) Other bank balances - - - 14.70 14.70

(e) Loans - non-current - - - 1.10 1.10

(f) Loans - current - - - 0.67 0.67

(g) Other financial assets - non-current - - 0.38 0.26 0.64

(h) Other financial assets - current - - 6.32 42.06 48.38

Total 2,230.69 972.75 6.70 2,187.86 5,398.00

Financial liabilities

(a) Borrowings - non-current - 1,087.93 1,087.93

(b) Borrowings - current - 522.50 522.50

(c) Trade payables - 511.73 511.73

(d) Other financial liabilities - non-current 1.35 0.35 1.70

(e) Other financial liabilities - current 20.72 635.57 656.29

Total 22.07 2,758.08 2,780.15

(b) Fair value hierarchy

All assets and liabilities for which fair value is measured or disclosed in the financial statements are categorised within the fair value hierarchy,

described as follows:

Level 1 - Quoted (unadjusted) market prices in active markets for identical assets or liabilities

Level 2 - Valuation techniques for which the lowest level input that is significant to the fair value measurement is directly or indirectly observable

Level 3 - Valuation techniques for which the lowest level input that is significant to the fair value measurement is unobservable.

The following tables provides the fair value measurement hierarchy of the Company’s financials assets and liabilities that are measured at fair

value or where fair value disclosure is required.

` in crore

Particulars As at 31 March, 2018

Fair value measurement using

Total Quoted prices in Significant Significant

active markets observable unobservable

(Level 1) inputs (Level 2) inputs (Level 3)

Assets measured at fair value:

Derivative financial assets

Cross currency interest rate swaps 12.88 - 12.88 -

Options 0.08 - 0.08 -

Foreign exchange forward contracts 0.76 - 0.76 -

FVTOCI financial investments

Quoted equity instruments 1,718.84 1,718.84 - -

Unquoted equity instruments 647.77 - - 647.77

FVTPL financial investments

Unquoted debt instruments 977.63 - - 977.63

Liabilities measured at fair value:

Derivative financial liabilities

Foreign exchange forward contracts 0.13 - 0.13 -

Liabilities for which fair values are disclosed

Borrowings:

Unsecured Non-convertible debentures 256.32 256.32 - -

There have been no transfers between levels during the period.

182 Annual Report 2017-18