Page 104 - Tata_Chemicals_yearly-reports-2017-18

P. 104

Other expenses represent the following: INNOVATION AND TECHNOLOGY

` in crore Innovation Centre (‘IC’)

Entity Year ended Year ended Change % The Company established IC to undertake research in applied

31 March, 31 March, Change

2018 2017 sciences with a view to seeding new businesses and supporting

Changes in inventories of existing businesses with innovation. Presently, IC has total 81 active

finished goods, work-in- patents out of which 19 have been granted. In FY 2017-18, IC filed 11

progress and stock-in- new patent applications in various work areas.

trade (104) 113 (217) (192)

Stores and spares 271 250 21 8 The IC continues to work with TCL business units in the nutritional

consumed solutions, chemicals and consumer products; other Tata companies,

Packing materials 334 332 2 1 as well as carries out its own research and development activities.

consumed

Repairs 356 395 (39) (10) During the year, IC has developed significant additional capability in

Rent 154 163 (9) (6) Food Science and Technology. The R&D efforts in this area have led to

Royalty, rates and taxes 347 322 25 8 the development of innovative consumer products: pulse based mixes

Sales promotion expenses 160 194 (34) (18) (chilla mixes) and multi-grain khichdi which deliver convenience and

Others(*) 580 567 13 2 nutrition. The innovation centre also supported the TCL business in

Total 2,098 2,336 (238) (10) developing the technology for manufacture of pharmaceutical grade

sodium bicarbonate.

(*) – Others include insurance charges, Distributor’s service charges,

professional fees, foreign exchange loss, travelling expense, provision Digitalisation & Information Technology (D&IT)

for doubtful debts and advances, directors’ fees/commission and

The Company’s IT infrastructure is continuously reviewed and renewed

other expenses.

in line with business requirements and technology improvements. The

The other expenses have decreased primarily due to: Company has implemented common Enterprise Resource Planning

a. Movement in changes in inventories of finished goods, work-in- (‘ERP’) system across all its wholly owned operating subsidiaries.

progress and stock-in-trade is primarily on account of increase in During the year, the Company’s systems and infrastructure were

stock levels of agri business. augmented and modified to seamlessly support new requirements

such as GST and portfolio realignments.

b. Repair expenses lower at HFUK and TCNA.

c. Sales promotion expenses lower at TCL India. Various digitisation initiatives are taken by the Company to focus

on improving efficiency, enhancing stickiness with customers and

d. Others mainly due to lower travelling expenditure, professional

having better analytics to make informed decisions. A Customer

fee, foreign exchange loss and depreciating USD and GBP

Relationship Management (‘CRM’) and Distributor Management

exchange rates against INR.

System (‘DMS’) were implemented for chemicals business to

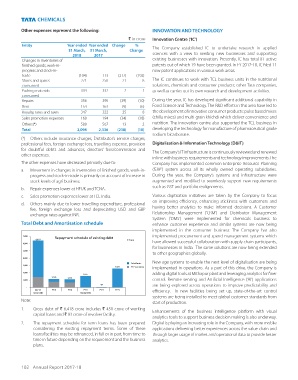

Total Debt and Amortisation schedule enhance customer experience and similar systems are now being

implemented in the consumer business. The Company has also

7,000 Repayment schedule of existing debt implemented procurement and spend management systems which

6,418 ` Crore

6,000 have allowed successful collaboration with supply chain participants,

for businesses in India. The same solutions are now being extended

5,000

to other geographies globally.

4,000

New age systems to enable the next level of digitalisation are being

Subsidiaries

3,000

2,561 TCL Standalone

implemented in operations. As a part of this drive, the Company is

2,000 adding digital tools at Mithapur plant and leveraging analytics for finer

1,555

1,126 1,114

1,000 control. Remote sensing and Artificial Intelligence (‘AI’) applications

59 are being explored across operations to improve predictability and

-

Mar'18 FY19 FY20 FY21 FY22 FY23 efficiency. In new facilities being set up, state-of-the-art control

Gross Debt Repayments

systems are being installed to meet global customer standards from

Note:

start of production.

1. Gross debt of ` 6,418 crore includes ` 450 crore of working

Enhancements of the business intelligence platform with visual

capital loans and ` 83 crore of revolver facility.

analytics tools to support business decision making is also underway.

2. The repayment schedule for term loans has been prepared Digital is playing an increasing role in the Company, with more mobile

considering the existing repayment terms. Some of these applications delivering better experiences across the value chain and

loans/facilities may be refinanced, in full or in part, from time to through larger usage of market and operational data to provide better

time in future depending on the requirement and the business analytics.

plans.

102 Annual Report 2017-18