Page 102 - Tata_Chemicals_yearly-reports-2017-18

P. 102

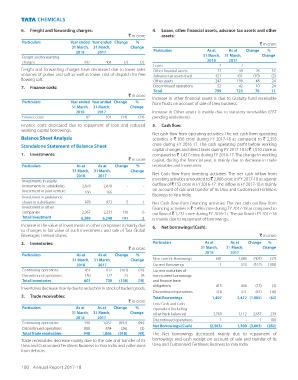

6. Freight and forwarding charges: 4. Loans, other financial assets, advance tax assets and other

` in crore assets:

Particulars Year ended Year ended Change %

` in crore

31 March, 31 March, Change

Particulars As at As at Change %

2018 2017

31 March, 31 March, Change

Freight and forwarding

2018 2017

charges 397 404 (7) (2)

Loans 2 2 - -

Freight and forwarding charges have decreased due to lower sales Other financial assets 77 49 28 57

volumes of pulses and salt as well as lower cost of dispatch for free Advance tax assets (net) 421 431 (10) (2)

flowing salt. Other assets 247 199 48 24

Discontinued operations 52 42 10 24

7. Finance costs:

Total 799 723 76 11

` in crore

Increase in other financial assets is due to Gratuity fund receivable

Particulars Year ended Year ended Change %

from Trusts on account of sale of Urea business.

31 March, 31 March, Change

2018 2017 Increase in Other assets is mainly due to statutory receivables (GST

Finance costs 87 101 (14) (14) pending settlement).

Finance costs decreased due to repayment of loan and reduced 5. Cash flow:

working capital borrowings.

Net cash flow from operating activities: The net cash from operating

Balance Sheet Analysis activities is ` 836 crore during FY 2017-18 as compared to ` 2,393

Standalone Statement of Balance Sheet crore during FY 2016-17. The cash operating profit before working

capital changes and direct taxes during FY 2017-18 is ` 1,510 crore as

1. Investments: compared to ` 1,437 crore during FY 2016-17. The change in working

` in crore capital, during the financial year, is mainly due to decrease in trade

Particulars As at As at Change % receivables and inventories.

31 March, 31 March, Change Net Cash flow from investing activities: The net cash inflow from

2018 2017

Investments in equity investing activities amounted to ` 2,866 crore in FY 2017-18 as against

instruments in subsidiaries 2,878 2,878 - - outflow of ` 152 crore in FY 2016-17. The inflow in FY 2017-18 is mainly

Investment in joint venture 166 166 - - on account of sale and transfer of its Urea and Customised Fertilisers

Investment in preference Business to Yara India.

shares in subsidiaries 978 973 5 1 Net Cash flow from financing activities: The net cash outflow from

Investment in other financing activities is ` 1,496 crore during FY 2017-18 as compared to

companies 2,367 2,231 136 6 outflow of ` 1,731 crore during FY 2016-17. The outflow in FY 2017-18

Total Investment 6,389 6,248 141 2 is mainly due to repayment of borrowings.

Increase in the value of investments in other companies is mainly due 6. Net borrowings/(Cash):

to changes in fair value of such investments and sale of Tata Global

Beverages Limited shares. ` in crore

2. Inventories: Particulars As at As at Change %

` in crore 31 March, 31 March, Change

2018 2017

Particulars As at As at Change %

31 March, 31 March, Change Non-current Borrowings 681 1,088 (407) (37)

2018 2017 Current Borrowings 1 523 (522) (100)

Continuing operations 451 612 (161) (26) Current maturities of

Discontinued operations 150 127 23 18 non-current borrowings

Total Inventories 601 739 (138) (19) and finance lease

obligations 415 430 (15) (3)

Inventories decrease mainly due to reduction in stock of traded goods.

Discontinued operations 310 371 (61) (16)

3. Trade receivables: Total Borrowings 1,407 2,412 (1,005) (42)

` in crore

Less: Cash and Cash

Particulars As at As at Change % equivalent (including

31 March, 31 March, Change other Bank balances) 3,769 1,112 2,657 239

2018 2017 Discontinued operations 1 - 1 100

Continuing operations 140 1,032 (892) (86)

Net Borrowings/(Cash) (2,363) 1,300 (3,663) (282)

Discontinued operations 808 834 (26) (3)

Total Trade receivables 948 1,866 (918) (49) The Net borrowings decreased mainly due to repayment of

Trade receivables decrease mainly due to the sale and transfer of its borrowings and cash receipt on account of sale and transfer of its

Urea and Customised Fertilisers Business to Yara India and collections Urea and Customised Fertilisers Business to Yara India.

from debtors.

100 Annual Report 2017-18