Page 43 - Tata Chemical Annual Report_2022-2023

P. 43

Integrated Annual Report 2022-23 01-83 84-192 193-365

Integrated Report Statutory Reports Financial Statements

Business Strategy

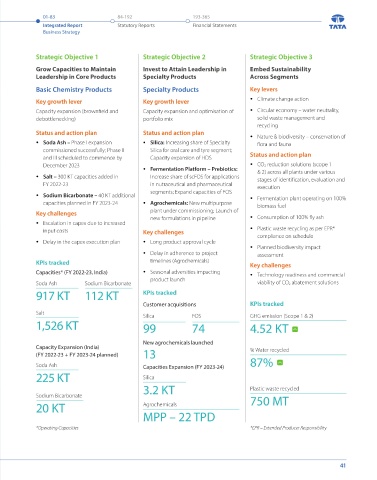

BUSINESS STRATEGY Strategic Objective 1 Strategic Objective 2 Strategic Objective 3

Responsible Leadership Rooted in Grow Capacities to Maintain Invest to Attain Leadership in Embed Sustainability

Leadership in Core Products

Across Segments

Specialty Products

Sustainability and Excellence Basic Chemistry Products Specialty Products Key levers

Key growth lever Key growth lever Climate change action

We strongly believe that sustainable practices and operational excellence together lead to the creation of robust

business foundations. Our focus is on continuously strengthening these twin metrics to reinforce our foundations to Capacity expansion (brownfield and Capacity expansion and optimisation of Circular economy – water neutrality,

consistently deliver high-quality products and services to our customers. We further believe that strong foundations debottlenecking) portfolio mix solid waste management and

are the key to reducing operational costs and building functional excellence to ensure sustained business resilience. recycling

Status and action plan Status and action plan

Nature & biodiversity – conservation of

Soda Ash – Phase I expansion Silica: Increasing share of Specialty flora and fauna

commissioned successfully; Phase II Silica for oral care and tyre segment;

and III scheduled to commence by Capacity expansion of HDS Status and action plan

December 2023 CO 2 reduction solutions (scope 1

Strategy Fermentation Platform – Prebiotics: & 2) across all plants under various

Salt – 300 KT capacities added in Increase share of scFOS for applications

Chemistry for Sustainable Growth stages of identification, evaluation and

FY 2022-23 in nutraceutical and pharmaceutical execution

segments; Expand capacities of FOS

Sodium Bicarbonate – 40 KT additional Fermentation plant operating on 100%

capacities planned in FY 2023-24 Agrochemicals: New multipurpose biomass fuel

Expand Embed Excel Key challenges plant under commissioning; Launch of

To grow for Sustainability Operational new formulations in pipeline Consumption of 100% fly ash

sustained across all the and functional Escalation in capex due to increased

leadership segments excellence input costs Key challenges Plastic waste recycling as per EPR*

compliance on schedule

Delay in the capex execution plan Long product approval cycle

Planned biodiversity impact

Delay in adherence to project assessment

Responsible Leadership Rooted in Sustainability and Excellence

KPIs tracked timelines (Agrochemicals) Key challenges

We have strategically identified, and are pursuing, the following Capacities* (FY 2022-23, India) Seasonal adversities impacting Technology readiness and commercial

key objectives to steer our business strategy of sustainable product launch viability of CO 2 abatement solutions

growth backed by excellence. These well-defined strategic Soda Ash Sodium Bicarbonate

objectives are aimed at strengthening our responsible 917 KT 112 KT KPIs tracked

leadership position in the Chemicals industry. Customer acquisitions KPIs tracked

Salt Silica FOS GHG emission (Scope 1 & 2)

1,526 KT 99 74 4.52 KT

New agrochemicals launched

Capacity Expansion (India) % Water recycled

(FY 2022-23 + FY 2023-24 planned) 13

Soda Ash Capacities Expansion (FY 2023-24) 87%

225 KT Silica

3.2 KT Plastic waste recycled

Sodium Bicarbonate 750 MT

20 KT Agrochemicals

MPP – 22 TPD

*Operating Capacities *EPR – Extended Producer Responsibility

40 41