Page 340 - Tata_Chemicals_yearly-reports-2021-22

P. 340

Integrated Annual Report 2021-22

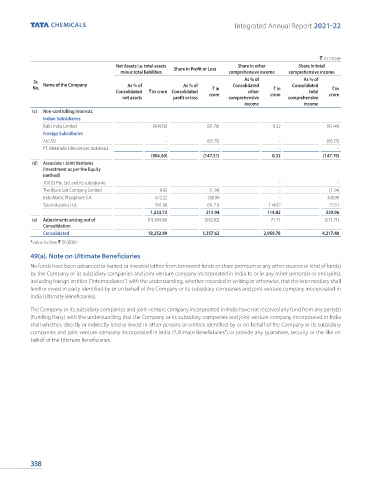

` in crore

Net Assets i.e. total assets Share in Profit or Loss Share in other Share in total

minus total liabilities comprehensive income comprehensive income

Sr. Name of the Company As % of As % of

No. As % of As % of ` in Consolidated ` in Consolidated ` in

Consolidated ` in crore Consolidated crore other crore total crore

net assets profit or loss comprehensive comprehensive

income income

(c) Non-controlling Interests

Indian Subsidiaries

Rallis India Limited (904.50) (81.76) 0.32 (81.44)

Foreign Subsidiaries

ALCAD - (65.75) - (65.75)

PT. Metahelix Lifesciences Indonesia - - - -

(904.50) (147.51) 0.32 (147.19)

(d) Associate / Joint Ventures

(Investment as per the Equity

method)

JOil (S) Pte. Ltd. and its subsidiaries - - - -

The Block Salt Company Limited 0.42 (1.34) - (1.34)

Indo Maroc Phosphore S.A. 672.22 308.99 - 308.99

Tata Industries Ltd. 561.08 (91.71) 114.02 22.31

1,233.72 215.94 114.02 329.96

(e) Adjustments arising out of (19,384.96) (582.82) 71.11 (511.71)

Consolidation

Consolidated 18,252.89 1,257.62 2,959.78 4,217.40

*value below ` 50,000/-

49(a). Note on Ultimate Beneficiaries

No funds have been advanced or loaned or invested (either from borrowed funds or share premium or any other sources or kind of funds)

by the Company or its subsidiary companies and joint venture company incorporated in India to or in any other person(s) or entity(ies),

including foreign entities (“Intermediaries”) with the understanding, whether recorded in writing or otherwise, that the Intermediary shall

lend or invest in party identified by or on behalf of the Company or its subsidiary companies and joint venture company incorporated in

India (Ultimate Beneficiaries).

The Company or its subsidiary companies and joint venture company incorporated in India have not received any fund from any party(s)

(Funding Party) with the understanding that the Company or its subsidiary companies and joint venture company incorporated in India

shall whether, directly or indirectly lend or invest in other persons or entities identified by or on behalf of the Company or its subsidiary

companies and joint venture company incorporated in India (“Ultimate Beneficiaries”) or provide any guarantee, security or the like on

behalf of the Ultimate Beneficiaries.

338