Page 339 - Tata_Chemicals_yearly-reports-2021-22

P. 339

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

REPORT

STATEMENTS

REPORTS

Consolidated

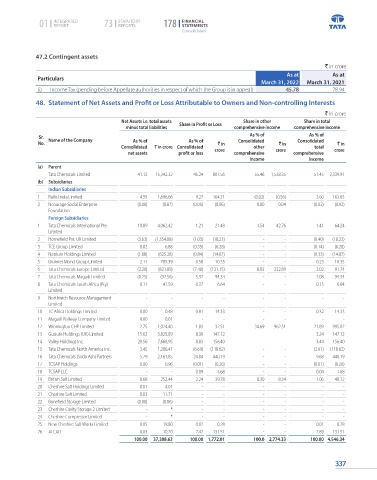

47.2 Contingent assets

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

(i) Income Tax (pending before Appellate authorities in respect of which the Group is in appeal) 45.78 78.94

48. Statement of Net Assets and Profit or Loss Attributable to Owners and Non-controlling Interests

` in crore

Net Assets i.e. total assets Share in other Share in total

minus total liabilities Share in Profit or Loss comprehensive income comprehensive income

Sr. As % of As % of

No. Name of the Company As % of As % of ` in Consolidated ` in Consolidated ` in

Consolidated ` in crore Consolidated crore other crore total crore

net assets profit or loss comprehensive comprehensive

income income

(a) Parent

Tata Chemicals Limited 41.12 15,342.32 45.24 801.56 55.46 1,538.35 51.45 2,339.91

(b) Subsidiaries

Indian Subsidiaries

1 Rallis India Limited 4.55 1,696.66 9.27 164.21 (0.02) (0.56) 3.60 163.65

2 Ncourage Social Enterprise (0.00) (0.87) (0.05) (0.96) 0.00 0.04 (0.02) (0.92)

Foundation

Foreign Subsidiaries

1 Tata Chemicals International Pte. 10.89 4,062.42 1.21 21.48 1.54 42.76 1.41 64.24

Limited

2 Homefield Pvt. UK Limited (3.63) (1,354.08) (1.03) (18.23) - - (0.40) (18.23)

3 TCE Group Limited 0.02 6.88 (0.35) (6.28) - - (0.14) (6.28)

4 Natrium Holdings Limited (1.68) (625.28) (0.84) (14.87) - - (0.33) (14.87)

5 Brunner Mond Group Limited 2.11 785.39 0.58 10.35 - - 0.23 10.35

6 Tata Chemicals Europe Limited (2.20) (821.89) (7.40) (131.15) 8.03 222.89 2.02 91.74

7 Tata Chemicals Magadi Limited (0.25) (92.56) 5.32 94.34 - - 2.08 94.34

8 Tata Chemicals South Africa (Pty) 0.11 42.59 0.37 6.64 - - 0.15 6.64

Limited

9 Northwich Resource Management - - - - - - - -

Limited

10 TC Africa Holdings Limited 0.00 0.48 0.81 14.33 - - 0.32 14.33

11 Magadi Railway Company Limited 0.00 0.01 - - - - - -

12 Winnington CHP Limited 2.75 1,024.40 1.83 32.51 34.69 962.51 21.89 995.02

13 Gusiute Holdings (UK) Limited 15.62 5,825.89 8.30 147.12 - - 3.24 147.12

14 Valley Holdings Inc. 20.56 7,668.95 8.83 156.40 - - 3.44 156.40

15 Tata Chemicals North America Inc. 3.45 1,286.41 (6.69) (118.62) - - (2.61) (118.62)

16 Tata Chemicals (Soda Ash) Partners 5.79 2,161.85 24.84 440.19 - - 9.68 440.19

17 TCSAP Holdings 0.00 0.96 (0.01) (0.26) - - (0.01) (0.26)

18 TCSAP LLC - - 0.09 1.68 - - 0.04 1.68

19 British Salt Limited 0.68 252.44 2.24 39.78 0.30 8.34 1.06 48.12

20 Cheshire Salt Holdings Limited 0.01 4.01 - - - - - -

21 Cheshire Salt Limited 0.03 11.71 - - - - - -

22 Brinefield Storage Limited (0.00) (0.06) - - - - - -

23 Cheshire Cavity Storage 2 Limited - * - - - - - -

24 Cheshire Compressor Limited - * - - - - - -

25 New Cheshire Salt Works Limited 0.05 19.80 0.02 0.28 - - 0.01 0.28

26 ALCAD 0.03 10.20 7.42 131.51 - - 2.89 131.51

100.00 37,308.63 100.00 1,772.01 100.0 2,774.33 100.00 4,546.34

337