Page 231 - Tata_Chemicals_yearly-reports-2021-22

P. 231

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

STATEMENTS

REPORTS

REPORT

Standalone

` in crore

Year ended Year ended

Particulars

March 31, 2022 March 31, 2021

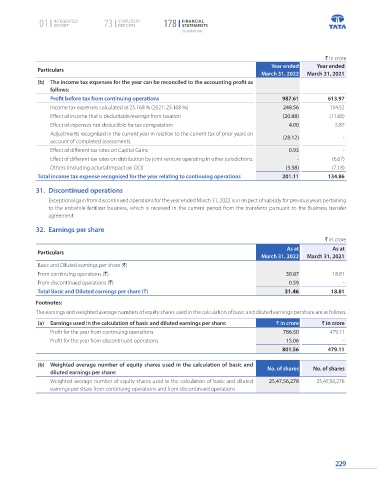

(b) The income tax expenses for the year can be reconciled to the accounting profit as

follows:

Profit before tax from continuing operations 987.61 613.97

Income tax expenses calculated at 25.168 % (2021: 25.168 %) 248.56 154.52

Effect of income that is deductable/exempt from taxation (20.88) (11.68)

Effect of expenses not deductible for tax computation 4.00 5.87

Adjustments recognised in the current year in relation to the current tax of prior years on (28.12) -

account of completed assessments.

Effect of different tax rates on Capital Gains 0.93 -

Effect of different tax rates on distribution by joint venture operating in other jurisdictions. - (6.67)

Others (including acturial impact on OCI) (3.38) (7.18)

Total income tax expense recognised for the year relating to continuing operations 201.11 134.86

31. Discontinued operations

Exceptional gain from discontinued operations for the year ended March 31, 2022 is in respect of subsidy for previous years pertaining

to the erstwhile fertilizer business, which is received in the current period from the transferor pursuant to the Business transfer

agreement.

32. Earnings per share

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

Basic and Diluted earnings per share (`)

From continuing operations (`) 30.87 18.81

From discontinued operations (`) 0.59 -

Total Basic and Diluted earnings per share (`) 31.46 18.81

Footnotes:

The earnings and weighted average numbers of equity shares used in the calculation of basic and diluted earnings per share are as follows.

(a) Earnings used in the calculation of basic and diluted earnings per share: ` in crore ` in crore

Profit for the year from continuing operations 786.50 479.11

Profit for the year from discontinued operations 15.06 -

801.56 479.11

(b) Weighted average number of equity shares used in the calculation of basic and No. of shares No. of shares

diluted earnings per share:

Weighted average number of equity shares used in the calculation of basic and diluted 25,47,56,278 25,47,56,278

earnings per share from continuing operations and from discontinued operations

229