Page 234 - Tata_Chemicals_yearly-reports-2021-22

P. 234

Integrated Annual Report 2021-22

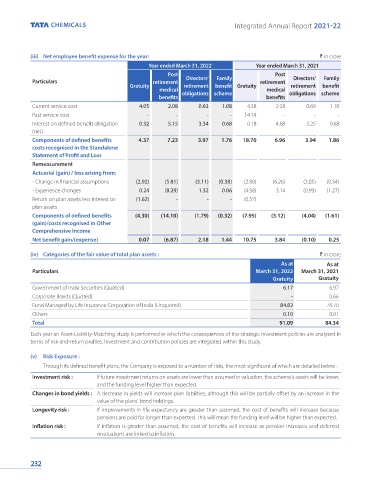

(iii) Net employee benefit expense for the year: ` in crore

Year ended March 31, 2022 Year ended March 31, 2021

Post Post

Particulars retirement Directors' Family retirement Directors' Family

Gratuity retirement benefit Gratuity retirement benefit

medical obligations scheme medical obligations scheme

benefits benefits

Current service cost 4.05 2.08 0.63 1.08 4.38 2.28 0.69 1.18

Past service cost - - - - 14.14 - - -

Interest on defined benefit obligation 0.32 5.15 3.34 0.68 0.18 4.68 3.25 0.68

(net)

Components of defined benefits 4.37 7.23 3.97 1.76 18.70 6.96 3.94 1.86

costs recognised in the Standalone

Statement of Profit and Loss

Remeasurement

Actuarial (gain) / loss arising from:

- Change in financial assumptions (2.92) (5.81) (3.11) (0.38) (2.80) (6.26) (3.05) (0.34)

- Experience changes 0.24 (8.29) 1.32 0.06 (4.58) 3.14 (0.99) (1.27)

Return on plan assets less interest on (1.62) - - - (0.57) - - -

plan assets

Components of defined benefits (4.30) (14.10) (1.79) (0.32) (7.95) (3.12) (4.04) (1.61)

(gain)/costs recognised in Other

Comprehensive Income

Net benefit gain/(expense) 0.07 (6.87) 2.18 1.44 10.75 3.84 (0.10) 0.25

(iv) Categories of the fair value of total plan assets : ` in crore

As at As at

Particulars March 31, 2022 March 31, 2021

Gratuity Gratuity

Government of India Securities (Quoted) 6.17 6.97

Corporate Bonds (Quoted) - 0.66

Fund Managed by Life Insurance Corporation of India (Unquoted) 84.82 76.70

Others 0.10 0.01

Total 91.09 84.34

Each year an Asset-Liability-Matching study is performed in which the consequences of the strategic investment policies are analysed in

terms of risk-and-return profiles. Investment and contribution policies are integrated within this study.

(v) Risk Exposure :

Through its defined benefit plans, the Company is exposed to a number of risks, the most significant of which are detailed below :

Investment risk : If future investment returns on assets are lower than assumed in valuation, the scheme's assets will be lower,

and the funding level higher than expected.

Changes in bond yields : A decrease in yields will increase plan liabilities, although this will be partially offset by an increase in the

value of the plans' bond holdings.

Longevity risk : If improvements in life expectancy are greater than assumed, the cost of benefits will increase because

pensions are paid for longer than expected. This will mean the funding level will be higher than expected.

Inflation risk : If inflation is greater than assumed, the cost of benefits will increase as pension increases and deferred

revaluations are linked to inflation.

232