Page 227 - Tata_Chemicals_yearly-reports-2021-22

P. 227

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

STATEMENTS

REPORTS

REPORT

Standalone

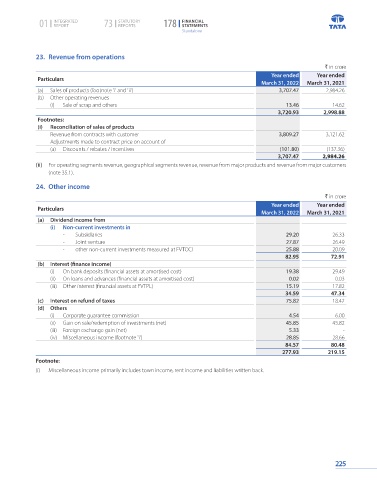

23. Revenue from operations

` in crore

Year ended Year ended

Particulars

March 31, 2022 March 31, 2021

(a) Sales of products (footnote 'i' and 'ii') 3,707.47 2,984.26

(b) Other operating revenues

(i) Sale of scrap and others 13.46 14.62

3,720.93 2,998.88

Footnotes:

(i) Reconciliation of sales of products

Revenue from contracts with customer 3,809.27 3,121.62

Adjustments made to contract price on account of

(a) Discounts / rebates / incentives (101.80) (137.36)

3,707.47 2,984.26

(ii) For operating segments revenue, geographical segments revenue, revenue from major products and revenue from major customers

(note 35.1).

24. Other income

` in crore

Year ended Year ended

Particulars

March 31, 2022 March 31, 2021

(a) Dividend income from

(i) Non-current investments in

- Subsidiaries 29.20 26.33

- Joint venture 27.87 26.49

- other non-current investments measured at FVTOCI 25.88 20.09

82.95 72.91

(b) Interest (finance income)

(i) On bank deposits (financial assets at amortised cost) 19.38 29.49

(ii) On loans and advances (financial assets at amortised cost) 0.02 0.03

(iii) Other interest (financial assets at FVTPL) 15.19 17.82

34.59 47.34

(c) Interest on refund of taxes 75.82 18.42

(d) Others

(i) Corporate guarantee commission 4.54 6.00

(ii) Gain on sale/redemption of investments (net) 45.85 45.82

(iii) Foreign exchange gain (net) 5.33 -

(iv) Miscellaneous income (footnote 'i') 28.85 28.66

84.57 80.48

277.93 219.15

Footnote:

(i) Miscellaneous income primarily includes town income, rent income and liabilities written back.

225