Page 233 - Tata_Chemicals_yearly-reports-2021-22

P. 233

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

STATEMENTS

REPORTS

REPORT

Standalone

Family benefit scheme is applicable to all permanent employees in management, officers and workmen who have completed one

year of continuous service. In case of untimely death of the employee, nominated beneficiary is entitled to an amount equal to the

last drawn salary (Basic Salary, DA and FDA) till the normal retirement date of the deceased employee.

The most recent actuarial valuations of plan assets and the present values of the defined benefit obligations were carried out at

March 31, 2022. The present value of the defined benefit obligations and the related current service cost and past service cost, were

measured using the Projected Unit Credit Method.

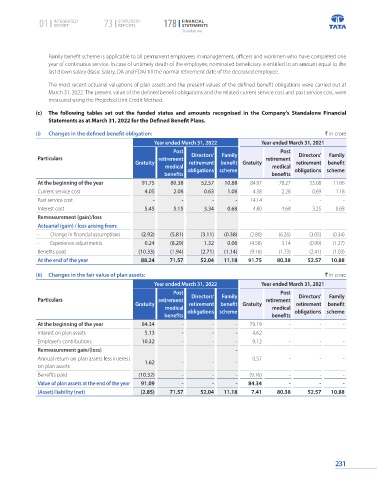

(c) The following tables set out the funded status and amounts recognised in the Company's Standalone Financial

Statements as at March 31, 2022 for the Defined Benefit Plans.

(i) Changes in the defined benefit obligation: ` in crore

Year ended March 31, 2022 Year ended March 31, 2021

Post Post

Particulars retirement Directors' Family retirement Directors' Family

Gratuity retirement benefit Gratuity retirement benefit

medical medical

benefits obligations scheme benefits obligations scheme

At the beginning of the year 91.75 80.38 52.57 10.88 84.97 78.27 55.08 11.66

Current service cost 4.05 2.08 0.63 1.08 4.38 2.28 0.69 1.18

Past service cost - - - - 14.14 - - -

Interest cost 5.45 5.15 3.34 0.68 4.80 4.68 3.25 0.68

Remeasurement (gain)/loss

Actuarial (gain) / loss arising from:

- Change in financial assumptions (2.92) (5.81) (3.11) (0.38) (2.80) (6.26) (3.05) (0.34)

- Experience adjustments 0.24 (8.29) 1.32 0.06 (4.58) 3.14 (0.99) (1.27)

Benefits paid (10.33) (1.94) (2.71) (1.14) (9.16) (1.73) (2.41) (1.03)

At the end of the year 88.24 71.57 52.04 11.18 91.75 80.38 52.57 10.88

(ii) Changes in the fair value of plan assets: ` in crore

Year ended March 31, 2022 Year ended March 31, 2021

Post Post

Particulars retirement Directors' Family retirement Directors' Family

Gratuity retirement benefit Gratuity retirement benefit

medical medical

benefits obligations scheme benefits obligations scheme

At the beginning of the year 84.34 - - - 79.19 - - -

Interest on plan assets 5.13 - - - 4.62 - - -

Employer's contributions 10.32 - - - 9.12 - - -

Remeasurement gain/(loss) -

Annual return on plan assets less interest 1.62 - - - 0.57 - - -

on plan assets

Benefits paid (10.32) - - - (9.16) - - -

Value of plan assets at the end of the year 91.09 - - - 84.34 - - -

(Asset)/liability (net) (2.85) 71.57 52.04 11.18 7.41 80.38 52.57 10.88

231