Page 224 - Tata_Chemicals_yearly-reports-2021-22

P. 224

Integrated Annual Report 2021-22

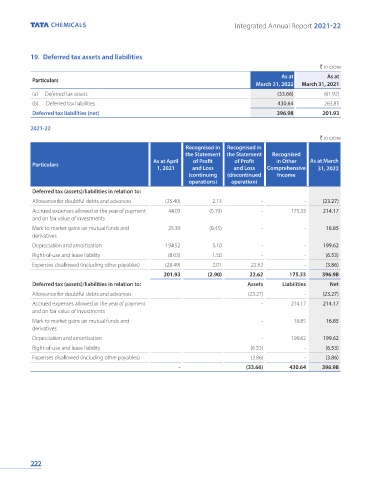

19. Deferred tax assets and liabilities

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

(a) Deferred tax assets (33.66) (61.92)

(b) Deferred tax liabilities 430.64 263.85

Deferred tax liabilities (net) 396.98 201.93

2021-22

` in crore

Recognised in Recognised in

the Statement the Statement Recognised

As at April of Profit of Profit in Other As at March

Particulars

1, 2021 and Loss and Loss Comprehensive 31, 2022

(continuing (discontinued Income

operations) operation)

Deferred tax (assets)/liabilities in relation to:

Allowance for doubtful debts and advances (25.40) 2.13 - - (23.27)

Accrued expenses allowed in the year of payment 44.03 (5.19) - 175.33 214.17

and on fair value of investments

Mark to market gains on mutual funds and 25.30 (8.45) - - 16.85

derivatives

Depreciation and amortisation 194.52 5.10 - - 199.62

Right-of-use and lease liability (8.03) 1.50 - - (6.53)

Expenses disallowed (including other payables) (28.49) 2.01 22.62 - (3.86)

201.93 (2.90) 22.62 175.33 396.98

Deferred tax (assets)/liabilities in relation to: Assets Liabilities Net

Allowance for doubtful debts and advances (23.27) - (23.27)

Accrued expenses allowed in the year of payment - 214.17 214.17

and on fair value of investments

Mark to market gains on mutual funds and - 16.85 16.85

derivatives

Depreciation and amortisation - 199.62 199.62

Right-of-use and lease liability (6.53) - (6.53)

Expenses disallowed (including other payables) (3.86) - (3.86)

- (33.66) 430.64 396.98

222