Page 222 - Tata_Chemicals_yearly-reports-2021-22

P. 222

Integrated Annual Report 2021-22

` in crore

Year ended Year ended

Particulars

March 31, 2022 March 31, 2021

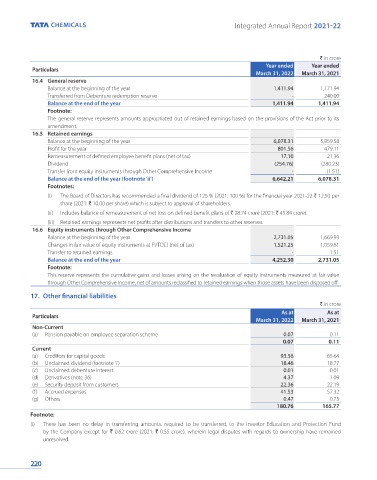

16.4 General reserve

Balance at the beginning of the year 1,411.94 1,171.94

Transferred from Debenture redemption reserve - 240.00

Balance at the end of the year 1,411.94 1,411.94

Footnote:

The general reserve represents amounts appropriated out of retained earnings based on the provisions of the Act prior to its

amendment.

16.5 Retained earnings

Balance at the beginning of the year 6,078.31 5,859.58

Profit for the year 801.56 479.11

Remeasurement of defined employee benefit plans (net of tax) 17.10 21.36

Dividend (254.76) (280.23)

Transfer from equity instruments through Other Comprehensive Income - (1.51)

Balance at the end of the year (footnote 'ii') 6,642.21 6,078.31

Footnotes:

(i) The Board of Directors has recommended a final dividend of 125 % (2021: 100 %) for the financial year 2021-22 ` 12.50 per

share (2021: ` 10.00 per share) which is subject to approval of shareholders.

(ii) Includes balance of remeasurement of net loss on defined benefit plans of ` 28.74 crore (2021: ` 45.84 crore).

(iii) Retained earnings represents net profits after distributions and transfers to other reserves.

16.6 Equity instruments through Other Comprehensive Income

Balance at the beginning of the year 2,731.05 1,669.93

Changes in fair value of equity instruments at FVTOCI (net of tax) 1,521.25 1,059.61

Transfer to retained earnings - 1.51

Balance at the end of the year 4,252.30 2,731.05

Footnote:

This reserve represents the cumulative gains and losses arising on the revaluation of equity instruments measured at fair value

through Other Comprehensive Income, net of amounts reclassified to retained earnings when those assets have been disposed off.

17. Other financial liabilities

` in crore

As at As at

Particulars

March 31, 2022 March 31, 2021

Non-Current

(a) Pension payable on employee separation scheme 0.07 0.11

0.07 0.11

Current

(a) Creditors for capital goods 93.56 65.64

(b) Unclaimed dividend (footnote 'i') 18.46 18.77

(c) Unclaimed debenture interest 0.01 0.01

(d) Derivatives (note 36) 4.37 1.09

(e) Security deposit from customers 22.36 22.19

(f) Accrued expenses 41.53 57.32

(g) Others 0.47 0.75

180.76 165.77

Footnote:

(i) There has been no delay in transferring amounts, required to be transferred, to the Investor Education and Protection Fund

by the Company except for ` 0.62 crore (2021: ` 0.55 crore), wherein legal disputes with regards to ownership have remained

unresolved.

220