Page 219 - Tata_Chemicals_yearly-reports-2021-22

P. 219

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

STATEMENTS

REPORTS

REPORT

Standalone

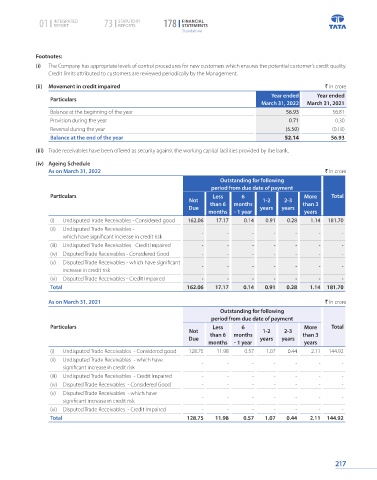

Footnotes:

(i) The Company has appropriate levels of control procedures for new customers which ensures the potential customer's credit quality.

Credit limits attributed to customers are reviewed periodically by the Management.

(ii) Movement in credit impaired ` in crore

Year ended Year ended

Particulars

March 31, 2022 March 31, 2021

Balance at the beginning of the year 56.93 56.81

Provision during the year 0.71 0.30

Reversal during the year (5.50) (0.18)

Balance at the end of the year 52.14 56.93

(iii) Trade receivables have been offered as security against the working capital facilities provided by the bank.

(iv) Ageing Schedule

As on March 31, 2022 ` in crore

Outstanding for following

period from due date of payment

Particulars Less 6 More Total

Not 1-2 2-3

Due than 6 months years years than 3

months - 1 year years

(i) Undisputed Trade Receivables - Considered good 162.06 17.17 0.14 0.91 0.28 1.14 181.70

(ii) Undisputed Trade Receivables - - - - - - - -

which have significant increase in credit risk

(iii) Undisputed Trade Receivables - Credit Impaired - - - - - - -

(iv) Disputed Trade Receivables - Considered Good - - - - - - -

(v) Disputed Trade Receivables - which have significant - - - - - - -

increase in credit risk

(vi) Disputed Trade Receivables - Credit Impaired - - - - - - -

Total 162.06 17.17 0.14 0.91 0.28 1.14 181.70

As on March 31, 2021 ` in crore

Outstanding for following

period from due date of payment

Particulars Less 6 More Total

Not 1-2 2-3

Due than 6 months years years than 3

months - 1 year years

(i) Undisputed Trade Receivables - Considered good 128.75 11.98 0.57 1.07 0.44 2.11 144.92

(ii) Undisputed Trade Receivables - which have - - - - - - -

significant increase in credit risk

(iii) Undisputed Trade Receivables - Credit Impaired - - - - - - -

(iv) Disputed Trade Receivables - Considered Good - - - - - - -

(v) Disputed Trade Receivables - which have - - - - - - -

significant increase in credit risk

(vi) Disputed Trade Receivables - Credit Impaired - - - - - - -

Total 128.75 11.98 0.57 1.07 0.44 2.11 144.92

217