Page 215 - Tata_Chemicals_yearly-reports-2021-22

P. 215

01 INTEGRATED 73 STATUTORY 178 FINANCIAL

STATEMENTS

REPORTS

REPORT

Standalone

7(b). Goodwill

Goodwill of ` 45.53 crore (2021: ` 45.53 crore) relates to the precipitated silica business. The estimated value in use of the CGU is based

on future Cash Flows of forecasted period of 20 years and discount rate of 13%, which consider the operating and macro-economic

environment in which the entity operates.

An analysis of the sensitivity of the change in key parameters (operating margin, discount rates and long term average growth rate), based

on reasonably probable assumptions, did not result in any probable scenario in which the recoverable amount of the CGU would decrease

below the carrying amount.

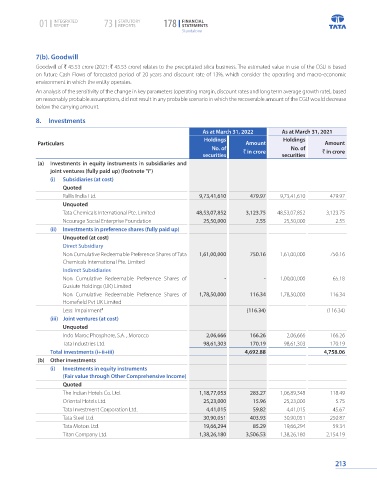

8. Investments

As at March 31, 2022 As at March 31, 2021

Holdings Holdings

Particulars Amount Amount

No. of ` in crore No. of ` in crore

securities securities

(a) Investments in equity instruments in subsidiaries and

joint ventures (fully paid up) (footnote "i")

(i) Subsidiaries (at cost)

Quoted

Rallis India Ltd. 9,73,41,610 479.97 9,73,41,610 479.97

Unquoted

Tata Chemicals International Pte. Limited 48,53,07,852 3,123.75 48,53,07,852 3,123.75

Ncourage Social Enterprise Foundation 25,50,000 2.55 25,50,000 2.55

(ii) Investments in preference shares (fully paid up)

Unquoted (at cost)

Direct Subsidiary

Non Cumulative Redeemable Preference Shares of Tata 1,61,00,000 750.16 1,61,00,000 750.16

Chemicals International Pte. Limited

Indirect Subsidiaries

Non Cumulative Redeemable Preference Shares of - - 1,00,00,000 65.18

Gusiute Holdings (UK) Limited

Non Cumulative Redeemable Preference Shares of 1,78,50,000 116.34 1,78,50,000 116.34

Homefield Pvt UK Limited

Less: Impairment # (116.34) (116.34)

(iii) Joint ventures (at cost)

Unquoted

Indo Maroc Phosphore, S.A. , Morocco 2,06,666 166.26 2,06,666 166.26

Tata Industries Ltd. 98,61,303 170.19 98,61,303 170.19

Total investments (i+ii+iii) 4,692.88 4,758.06

(b) Other investments

(i) Investments in equity instruments

(Fair value through Other Comprehensive Income)

Quoted

The Indian Hotels Co. Ltd. 1,18,77,053 283.27 1,06,89,348 118.49

Oriental Hotels Ltd. 25,23,000 15.96 25,23,000 5.75

Tata Investment Corporation Ltd. 4,41,015 59.82 4,41,015 45.67

Tata Steel Ltd. 30,90,051 403.93 30,90,051 250.87

Tata Motors Ltd. 19,66,294 85.29 19,66,294 59.34

Titan Company Ltd. 1,38,26,180 3,506.53 1,38,26,180 2,154.19

213