Page 269 - Tata_Chemicals_yearly-reports-2020-2021

P. 269

Integrated Report Statutory Reports Financial Statements

1-59 60-146 Consolidated

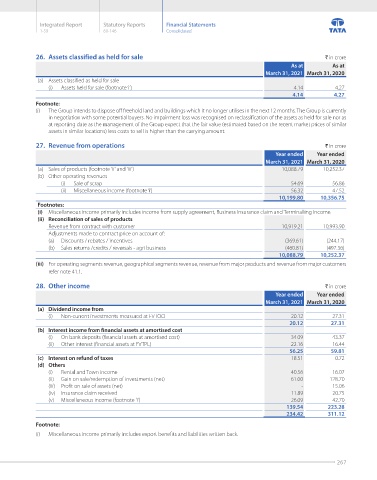

26. Assets classified as held for sale ` in crore

As at As at

March 31, 2021 March 31, 2020

(a) Assets classified as held for sale

(i) Assets held for sale (footnote ‘i’) 4.14 4.27

4.14 4.27

Footnote:

(i) The Group intends to dispose off freehold land and buildings which it no longer utilises in the next 12 months. The Group is currently

in negotiation with some potential buyers. No impairment loss was recognised on reclassification of the assets as held for sale nor as

at reporting date as the management of the Group expect that the fair value (estimated based on the recent market prices of similar

assets in similar locations) less costs to sell is higher than the carrying amount.

27. Revenue from operations ` in crore

Year ended Year ended

March 31, 2021 March 31, 2020

(a) Sales of products (footnote 'ii' and 'iii') 10,088.79 10,252.37

(b) Other operating revenues

(i) Sale of scrap 54.69 56.86

(ii) Miscellaneous income (footnote ‘i’) 56.32 47.52

10,199.80 10,356.75

Footnotes:

(i) Miscellaneous income primarily includes income from supply agreement, Business Insurance claim and Terminalling Income.

(ii) Reconciliation of sales of products

Revenue from contract with customer 10,919.21 10,993.90

Adjustments made to contract price on account of:

(a) Discounts / rebates / incentives (369.61) (244.17)

(b) Sales returns /credits / reversals - agri business (460.81) (497.36)

10,088.79 10,252.37

(iii) For operating segments revenue, geographical segments revenue, revenue from major products and revenue from major customers

refer note 41.1.

28. Other income ` in crore

Year ended Year ended

March 31, 2021 March 31, 2020

(a) Dividend income from

(i) Non-current investments measured at FVTOCI 20.12 27.31

20.12 27.31

(b) Interest income from financial assets at amortised cost

(i) On bank deposits (financial assets at amortised cost) 34.09 43.37

(ii) Other interest (financial assets at FVTPL) 22.16 16.44

56.25 59.81

(c) Interest on refund of taxes 18.51 0.72

(d) Others

(i) Rental and Town income 40.56 16.07

(ii) Gain on sale/redemption of investments (net) 61.00 128.70

(iii) Profit on sale of assets (net) - 15.06

(iv) Insurance claim received 11.89 20.75

(v) Miscellaneous income (footnote 'i') 26.09 42.70

139.54 223.28

234.42 311.12

Footnote:

(i) Miscellaneous income primarily includes export benefits and liabilities written back.

267