Page 268 - Tata_Chemicals_yearly-reports-2020-2021

P. 268

Integrated Annual Report 2020-21

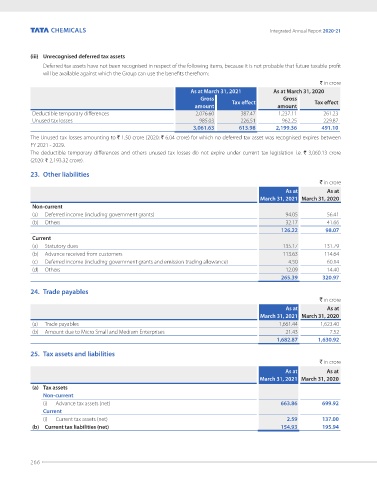

(iii) Unrecognised deferred tax assets

Deferred tax assets have not been recognised in respect of the following items, because it is not probable that future taxable profit

will be available against which the Group can use the benefits therefrom:

` in crore

As at March 31, 2021 As at March 31, 2020

Gross Gross

amount Tax effect amount Tax effect

Deductible temporary differences 2,076.60 387.47 1,237.11 261.23

Unused tax losses 985.03 226.51 962.25 229.87

3,061.63 613.98 2,199.36 491.10

The Unused tax losses amounting to ` 1.50 crore (2020: ` 6.04 crore) for which no deferred tax asset was recognised expires between

FY 2021 - 2029.

The deductible temporary differences and others unused tax losses do not expire under current tax legislation i.e. ` 3,060.13 crore

(2020: ` 2,193.32 crore).

23. Other liabilities

` in crore

As at As at

March 31, 2021 March 31, 2020

Non-current

(a) Deferred income (including government grants) 94.05 56.41

(b) Others 32.17 41.66

126.22 98.07

Current

(a) Statutory dues 135.17 131.79

(b) Advance received from customers 113.63 114.64

(c) Deferred income (including government grants and emission trading allowance) 4.50 60.14

(d) Others 12.09 14.40

265.39 320.97

24. Trade payables

` in crore

As at As at

March 31, 2021 March 31, 2020

(a) Trade payables 1,661.44 1,623.40

(b) Amount due to Micro Small and Medium Enterprises 21.43 7.52

1,682.87 1,630.92

25. Tax assets and liabilities

` in crore

As at As at

March 31, 2021 March 31, 2020

(a) Tax assets

Non-current

(i) Advance tax assets (net) 663.86 699.92

Current

(i) Current tax assets (net) 2.59 137.00

(b) Current tax liabilities (net) 154.93 195.94

266