Page 201 - Tata_Chemicals_yearly-reports-2020-2021

P. 201

Integrated Report Statutory Reports Financial Statements

1-59 60-146 Standalone

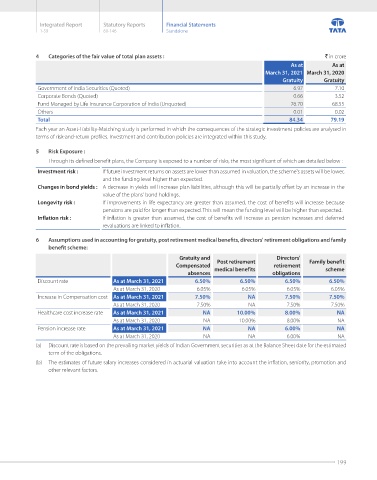

4 Categories of the fair value of total plan assets : ` in crore

As at As at

March 31, 2021 March 31, 2020

Gratuity Gratuity

Government of India Securities (Quoted) 6.97 7.10

Corporate Bonds (Quoted) 0.66 3.52

Fund Managed by Life Insurance Corporation of India (Unquoted) 76.70 68.55

Others 0.01 0.02

Total 84.34 79.19

Each year an Asset-Liability-Matching study is performed in which the consequences of the strategic investment policies are analysed in

terms of risk-and-return profiles. Investment and contribution policies are integrated within this study.

5 Risk Exposure :

Through its defined benefit plans, the Company is exposed to a number of risks, the most significant of which are detailed below :

Investment risk : If future investment returns on assets are lower than assumed in valuation, the scheme's assets will be lower,

and the funding level higher than expected.

Changes in bond yields : A decrease in yields will increase plan liabilities, although this will be partially offset by an increase in the

value of the plans' bond holdings.

Longevity risk : If improvements in life expectancy are greater than assumed, the cost of benefits will increase because

pensions are paid for longer than expected. This will mean the funding level will be higher than expected.

Inflation risk : If inflation is greater than assumed, the cost of benefits will increase as pension increases and deferred

revaluations are linked to inflation.

6 Assumptions used in accounting for gratuity, post retirement medical benefits, directors' retirement obligations and family

benefit scheme:

Gratuity and Directors'

Post retirement

Compensated medical benefits retirement Family benefit

scheme

absences obligations

Discount rate As at March 31, 2021 6.50% 6.50% 6.50% 6.50%

As at March 31, 2020 6.05% 6.05% 6.05% 6.05%

Increase in Compensation cost As at March 31, 2021 7.50% NA 7.50% 7.50%

As at March 31, 2020 7.50% NA 7.50% 7.50%

Healthcare cost increase rate As at March 31, 2021 NA 10.00% 8.00% NA

As at March 31, 2020 NA 10.00% 8.00% NA

Pension increase rate As at March 31, 2021 NA NA 6.00% NA

As at March 31, 2020 NA NA 6.00% NA

(a) Discount rate is based on the prevailing market yields of Indian Government securities as at the Balance Sheet date for the estimated

term of the obligations.

(b) The estimates of future salary increases considered in actuarial valuation take into account the inflation, seniority, promotion and

other relevant factors.

199