Page 198 - Tata_Chemicals_yearly-reports-2020-2021

P. 198

Integrated Annual Report 2020-21

Footnotes:

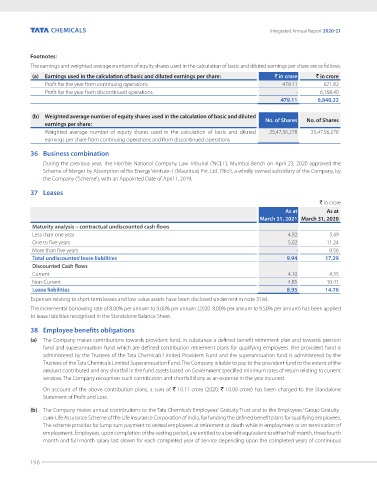

The earnings and weighted average numbers of equity shares used in the calculation of basic and diluted earnings per share are as follows.

(a) Earnings used in the calculation of basic and diluted earnings per share: ` in crore ` in crore

Profit for the year from continuing operations 479.11 671.82

Profit for the year from discontinued operations - 6,168.40

479.11 6,840.22

(b) Weighted average number of equity shares used in the calculation of basic and diluted No. of Shares No. of Shares

earnings per share:

Weighted average number of equity shares used in the calculation of basic and diluted 25,47,56,278 25,47,56,278

earnings per share from continuing operations and from discontinued operations

36 Business combination

During the previous year, The Hon'ble National Company Law Tribunal ('NCLT'), Mumbai Bench on April 23, 2020 approved the

Scheme of Merger by Absorption of Bio Energy Venture-1 (Mauritius) Pvt. Ltd. ('Bio'), a wholly owned subsidiary of the Company, by

the Company ('Scheme'), with an Appointed Date of April 1, 2019.

37 Leases

` in crore

As at As at

March 31, 2021 March 31, 2020

Maturity analysis – contractual undiscounted cash flows

Less than one year 4.92 5.49

One to five years 5.02 11.24

More than five years - 0.56

Total undiscounted lease liabilities 9.94 17.29

Discounted Cash flows

Current 4.10 4.35

Non-Current 4.85 10.41

Lease liabilities 8.95 14.76

Expenses relating to short-term leases and low value assets have been disclosed under rent in note 31(e).

The incremental borrowing rate of 8.00% per annum to 9.00% per annum (2020: 8.00% per annum to 9.50% per annum) has been applied

to lease liabilities recognised in the Standalone Balance Sheet.

38 Employee benefits obligations

(a) The Company makes contributions towards provident fund, in substance a defined benefit retirement plan and towards pension

fund and superannuation fund which are defined contribution retirement plans for qualifying employees. The provident fund is

administered by the Trustees of the Tata Chemicals Limited Provident Fund and the superannuation fund is administered by the

Trustees of the Tata Chemicals Limited Superannuation Fund. The Company is liable to pay to the provident fund to the extent of the

amount contributed and any shortfall in the fund assets based on Government specified minimum rates of return relating to current

services. The Company recognises such contribution and shortfall if any as an expense in the year incurred.

On account of the above contribution plans, a sum of ` 10.11 crore (2020: ` 10.00 crore) has been charged to the Standalone

Statement of Profit and Loss.

(b) The Company makes annual contributions to the Tata Chemicals Employees' Gratuity Trust and to the Employees' Group Gratuity-

cum-Life Assurance Scheme of the Life Insurance Corporation of India, for funding the defined benefit plans for qualifying employees.

The scheme provides for lump sum payment to vested employees at retirement or death while in employment or on termination of

employment. Employees, upon completion of the vesting period, are entitled to a benefit equivalent to either half month, three fourth

month and full month salary last drawn for each completed year of service depending upon the completed years of continuous

196