Page 196 - Tata_Chemicals_yearly-reports-2020-2021

P. 196

Integrated Annual Report 2020-21

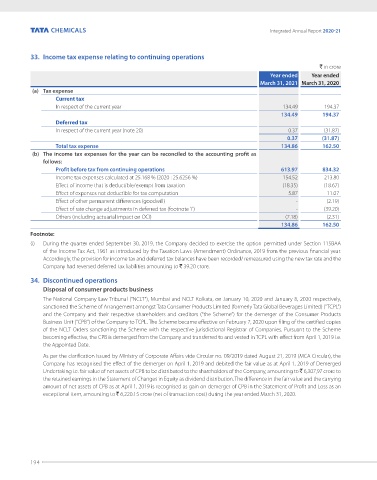

33. Income tax expense relating to continuing operations

` in crore

Year ended Year ended

March 31, 2021 March 31, 2020

(a) Tax expense

Current tax

In respect of the current year 134.49 194.37

134.49 194.37

Deferred tax

In respect of the current year (note 20) 0.37 (31.87)

0.37 (31.87)

Total tax expense 134.86 162.50

(b) The income tax expenses for the year can be reconciled to the accounting profit as

follows:

Profit before tax from continuing operations 613.97 834.32

Income tax expenses calculated at 25.168 % (2020 : 25.6256 %) 154.52 213.80

Effect of income that is deductible/exempt from taxation (18.35) (18.67)

Effect of expenses not deductible for tax computation 5.87 11.07

Effect of other permanent differences (goodwill) - (2.19)

Effect of rate change adjustments in deferred tax (footnote 'i') - (39.20)

Others (including actuarial impact on OCI) (7.18) (2.31)

134.86 162.50

Footnote:

(i) During the quarter ended September 30, 2019, the Company decided to exercise the option permitted under Section 115BAA

of the Income Tax Act, 1961 as introduced by the Taxation Laws (Amendment) Ordinance, 2019 from the previous financial year.

Accordingly, the provision for income tax and deferred tax balances have been recorded/ remeasured using the new tax rate and the

Company had reversed deferred tax liabilities amounting to ` 39.20 crore.

34. Discontinued operations

Disposal of consumer products business

The National Company Law Tribunal (“NCLT”), Mumbai and NCLT Kolkata, on January 10, 2020 and January 8, 2020 respectively,

sanctioned the Scheme of Arrangement amongst Tata Consumer Products Limited (formerly Tata Global Beverages Limited) ("TCPL")

and the Company and their respective shareholders and creditors (“the Scheme”) for the demerger of the Consumer Products

Business Unit ("CPB") of the Company to TCPL. The Scheme became effective on February 7, 2020 upon filing of the certified copies

of the NCLT Orders sanctioning the Scheme with the respective jurisdictional Registrar of Companies. Pursuant to the Scheme

becoming effective, the CPB is demerged from the Company and transferred to and vested in TCPL with effect from April 1, 2019 i.e.

the Appointed Date.

As per the clarification issued by Ministry of Corporate Affairs vide Circular no. 09/2019 dated August 21, 2019 (MCA Circular), the

Company has recognised the effect of the demerger on April 1, 2019 and debited the fair value as at April 1, 2019 of Demerged

Undertaking i.e. fair value of net assets of CPB to be distributed to the shareholders of the Company, amounting to ` 6,307,97 crore to

the retained earnings in the Statement of Changes in Equity as dividend distribution. The difference in the fair value and the carrying

amount of net assets of CPB as at April 1, 2019 is recognised as gain on demerger of CPB in the Statement of Profit and Loss as an

exceptional item, amounting to ` 6,220.15 crore (net of transaction cost) during the year ended March 31, 2020.

194