Page 200 - Tata_Chemicals_yearly-reports-2020-2021

P. 200

Integrated Annual Report 2020-21

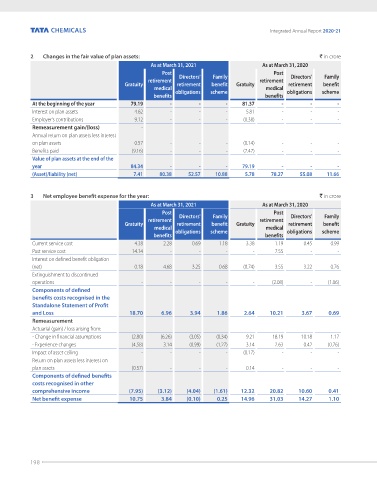

2 Changes in the fair value of plan assets: ` in crore

As at March 31, 2021 As at March 31, 2020

Post Post

retirement Directors' Family retirement Directors' Family

Gratuity retirement benefit Gratuity retirement benefit

medical medical

benefits obligations scheme benefits obligations scheme

At the beginning of the year 79.19 - - - 81.37 - - -

Interest on plan assets 4.62 - - - 5.81 - - -

Employer's contributions 9.12 - - - (0.38) - - -

Remeasurement gain/(loss) -

Annual return on plan assets less interest

on plan assets 0.57 - - - (0.14) - - -

Benefits paid (9.16) - - - (7.47) - - -

Value of plan assets at the end of the

year 84.34 - - - 79.19 - - -

(Asset)/liability (net) 7.41 80.38 52.57 10.88 5.78 78.27 55.08 11.66

3 Net employee benefit expense for the year: ` in crore

As at March 31, 2021 As at March 31, 2020

Post Post

retirement Directors' Family retirement Directors' Family

Gratuity retirement benefit Gratuity retirement benefit

medical medical

benefits obligations scheme benefits obligations scheme

Current service cost 4.38 2.28 0.69 1.18 3.38 1.19 0.45 0.99

Past service cost 14.14 - - - - 7.55 - -

Interest on defined benefit obligation

(net) 0.18 4.68 3.25 0.68 (0.74) 3.55 3.22 0.76

Extinguishment to discontinued

operations - - - - - (2.08) - (1.06)

Components of defined

benefits costs recognised in the

Standalone Statement of Profit

and Loss 18.70 6.96 3.94 1.86 2.64 10.21 3.67 0.69

Remeasurement

Actuarial (gain) / loss arising from:

- Change in financial assumptions (2.80) (6.26) (3.05) (0.34) 9.21 18.19 10.18 1.17

- Experience changes (4.58) 3.14 (0.99) (1.27) 3.14 2.63 0.42 (0.76)

Impact of asset ceiling - - - - (0.17) - - -

Return on plan assets less interest on

plan assets (0.57) - - - 0.14 - - -

Components of defined benefits

costs recognised in other

comprehensive income (7.95) (3.12) (4.04) (1.61) 12.32 20.82 10.60 0.41

Net benefit expense 10.75 3.84 (0.10) 0.25 14.96 31.03 14.27 1.10

198