Page 314 - Tata_Chemicals_yearly-reports-2019-20

P. 314

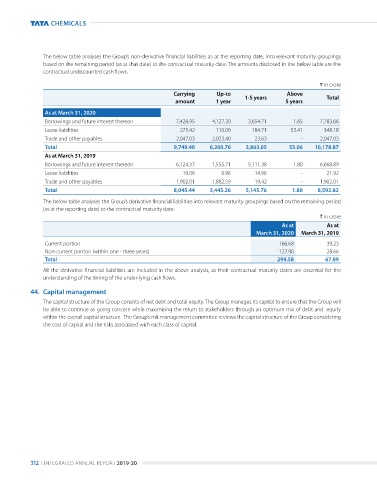

the below table analyses the group’s non-derivative financial liabilities as at the reporting date, into relevant maturity groupings

based on the remaining period (as at that date) to the contractual maturity date. the amounts disclosed in the below table are the

contractual undiscounted cash flows.

` in crore

Carrying Up-to 1-5 years Above Total

amount 1 year 5 years

As at March 31, 2020

Borrowings and future interest thereon 7,426.95 4,127.30 3,654.71 1.65 7,783.66

lease liabilities 275.42 110.06 184.71 53.41 348.18

trade and other payables 2,047.03 2,023.40 23.63 - 2,047.03

Total 9,749.40 6,260.76 3,863.05 55.06 10,178.87

As at March 31, 2019

Borrowings and future interest thereon 6,124.37 1,555.71 5,111.38 1.80 6,668.89

lease liabilities 19.06 6.96 14.96 - 21.92

trade and other payables 1,902.01 1,882.59 19.42 - 1,902.01

Total 8,045.44 3,445.26 5,145.76 1.80 8,592.82

the below table analyses the group’s derivative financial liabilities into relevant maturity groupings based on the remaining period

(as at the reporting date) to the contractual maturity date.

` in crore

As at As at

March 31, 2020 March 31, 2019

Current portion 166.68 39.23

non-current portion (within one - three years) 127.90 28.66

Total 294.58 67.89

all the derivative financial liabilities are included in the above analysis, as their contractual maturity dates are essential for the

understanding of the timing of the under-lying cash flows.

44. Capital management

the capital structure of the group consists of net debt and total equity. the group manages its capital to ensure that the group will

be able to continue as going concern while maximising the return to stakeholders through an optimum mix of debt and equity

within the overall capital structure. the group’s risk management committee reviews the capital structure of the group considering

the cost of capital and the risks associated with each class of capital.

312 I Integrated annual report 2019-20